16th Finance Commission: Reimagining Fiscal Federalism

The 16th Finance Commission has submitted its report, with a strong focus on strengthening the finances of Panchayats and Municipalities. This topic explains the constitutional role of the Finance Commission under Article 280, the problem of Vertical Fiscal Imbalance (VFI), the politics of tax devolution and cesses, and the urgent need to empower Urban Local Bodies (ULBs) and rural local governments as the 'third tier' of India’s federal structure.

Introduction

Context & Background

Key Points

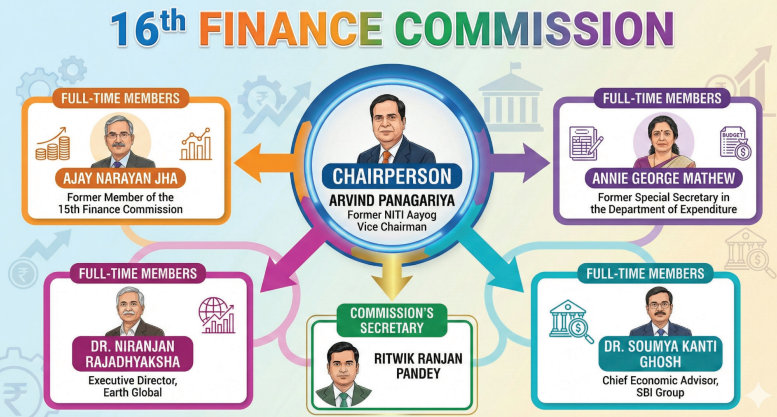

- •Constitutional Mandate (Article 280): The Finance Commission consists of a Chairperson and four other members appointed by the President. Parliament lays down their qualifications and manner of selection. The core duty is to recommend: (1) distribution of net tax proceeds between Centre and States (Vertical Devolution), and among States (Horizontal Devolution); (2) principles governing Grants-in-Aid under Article 275; (3) measures to augment State finances to enable them to support Panchayats and Municipalities (73rd and 74th Amendment obligations); and (4) any other matter referred by the President in the Terms of Reference (ToR).

- •Evolution of Devolution: 10th to 16th FC: Over time, Finance Commissions have gradually increased the share of States in central taxes. Earlier Commissions recommended lower devolution percentages (e.g., sub-30%), whereas later ones, especially after economic reforms and demands for cooperative federalism, have pushed this up (e.g., 42% by 14th FC and 41% by 15th FC). The 16th FC has to revisit this in light of increasing State responsibilities and fiscal stress, with many States demanding a further hike in their share.

- •Terms of Reference (ToR) for 16th FC: The President’s ToR typically includes:

1. Tax Sharing: Recommending the percentage of the net proceeds of shareable central taxes to be devolved to States.

2. Grants-in-Aid (Article 275): Laying down principles for post-devolution revenue deficit grants and sectoral grants (health, education, infrastructure, etc.).

3. Local Bodies (Article 280(3)(bb) & (c)): Recommending measures to augment the Consolidated Fund of States so that they can adequately finance Panchayats and Municipalities—this links directly to the 73rd and 74th Amendments.

4. Disaster Management: Reviewing the structure and size of funds under the Disaster Management Act, 2005, such as the National Disaster Response Fund (NDRF) and State Disaster Response Funds (SDRF), in the context of more frequent climate events. - •Urban Local Bodies (ULB) Crisis: India’s cities are economic engines. They generate roughly 60% of GDP, but their financial resources are disproportionately small.

1. Low Transfers: Inter-governmental transfers to ULBs are estimated at barely around 0.5% of GDP, whereas many other developing countries devote between 2–5% of GDP to local governments.

2. Post-GST Revenue Shock: After implementation of GST, many local taxes (such as octroi, entry tax) were subsumed, reducing city-level own tax revenues. In several States, local own revenue as a share of total ULB income has fallen from around 23% to under 10%, increasing dependence on State and central grants.

3. Weak Property Tax & User Charges: Property tax—potentially the most important local tax—is under-assessed, poorly collected and politically sensitive. User charges for water, sewerage, solid waste, and public transport are often set below cost-recovery levels.

4. Data Gaps & Census Delay: Without the 2021 Census, many formula-based grants still rely on 2011 population figures, ignoring rapid urbanisation, new towns, and the informal expansion of city regions. - •Vertical & Horizontal Fiscal Imbalances: Vertical Fiscal Imbalance (VFI) refers to the mismatch between the Centre’s revenue-raising powers and States’ expenditure responsibilities. States account for roughly around 60% of public expenditure (on core sectors) but have access to only about 35–40% of own tax revenues. This makes them dependent on transfers (tax devolution + grants). Horizontal Imbalance occurs between richer and poorer States—for example, between southern/western States with strong tax bases and some northern/eastern States with higher poverty and weaker tax bases. The Finance Commission seeks to balance equity (helping poorer States) and efficiency (rewarding better performance) in its formula.

- •Vertical Devolution vs Grants: Tax devolution is an untied transfer—States are free to spend it according to their priorities. Grants-in-aid can be tied (sector-specific), untied (revenue deficit grants), or performance-based (rewarding improvements in tax effort, health outcomes, school enrolment, environmental indicators, etc.). The 16th FC’s design of grants will shape incentives for States on issues like climate action, urban reforms, social sector outcomes and fiscal discipline.

- •Performance-Based and Reform-Linked Grants: Recent Commissions have increasingly used performance-based grants—for example, requiring local bodies to publish audited accounts, improve own revenue mobilisation, or adopt specific reforms (e.g., property tax reform, double-entry accounting, creation of State Finance Commissions). The 16th FC is expected to deepen this by linking a portion of grants to measurable improvements in governance, gender budgeting, environmental sustainability and SDG indicators.

- •Permanent Status Proposal: Currently, each Finance Commission is a temporary body that exists for a fixed term and then winds up. Many experts argue for converting it into a permanent institution with a small core secretariat and rotating members. This would allow continuous data collection, long-term research, regular monitoring of implementation of previous recommendations, and smoother preparation for the next award cycle.

- •States’ Demand for Higher Devolution: Given rising social sector commitments, infrastructure needs, and the pressure to implement centrally sponsored schemes (CSS), many States argue that the current 41% share of net Union taxes is not enough. Some suggest increasing it to around 49% and simultaneously rationalising cesses and surcharges so that the divisible pool itself is not artificially shrunk.

- •Interaction with State Finance Commissions (SFCs): While the Union Finance Commission focuses on Centre–State transfers, each State is supposed to set up its own State Finance Commission (SFC) every five years to recommend sharing of State revenues with Panchayats and Municipalities. In practice, SFCs are often delayed, weak, or poorly implemented. The 16th FC can influence local body finances by requiring States to constitute and act on SFC reports as a condition for receiving local body grants.

Functions of Finance Commission (Article 280)

| Function | Description | Bookmark |

|---|---|---|

| Vertical Devolution | Recommending what % of the net proceeds of shareable Central Taxes should be devolved to all States collectively (e.g., 41% under the 15th FC). | |

| Horizontal Devolution | Designing a formula to decide each State’s share using indicators like population, income distance, area, forest cover, tax effort, etc. | |

| Grants-in-Aid | Recommending revenue deficit grants and sector-specific grants (health, education, infrastructure, climate resilience) to States, especially those with weaker fiscal capacity. | |

| Local Body Support | Suggesting measures to augment the Consolidated Fund of States so that Panchayats and Municipalities receive predictable, rule-based transfers. | |

| Other Tasks (ToR-based) | Advising on disaster management funds, performance-based incentives, and any special issues referred by the President. |

Qualifications for Finance Commission Members (as per FC Act)

| Role | Qualification Criteria | Bookmark |

|---|---|---|

| Chairperson | Should be a person having experience in public affairs (e.g., senior administrator, public finance expert). | |

| Member 1 | Judge of a High Court or one qualified to be appointed as such. | |

| Member 2 | Person having specialised knowledge of Government finances and accounts. | |

| Member 3 | Person having wide experience in financial matters and in administration. | |

| Member 4 | Person having special knowledge of economics. |

Vertical vs Horizontal Fiscal Imbalance

| Type of Imbalance | Definition | Example / Relevance | Bookmark |

|---|---|---|---|

| Vertical Fiscal Imbalance (VFI) | Mismatch between revenue powers and expenditure responsibilities of different levels of government (Union vs States). | Union controls most buoyant taxes, but States spend more on health, education, etc., so they depend on tax devolution and grants. | |

| Horizontal Imbalance | Differences in revenue capacity and expenditure needs across States. | Richer States like some in the South/West vs poorer States in North/East; FC uses formula to correct for this. |

Related Entities

Impact & Significance

- •Strengthening Grassroots Democracy: By focusing on predictable, rule-based transfers to Panchayats and Municipalities, the 16th FC can operationalise the intent of the 73rd and 74th Constitutional Amendments. Financially empowered local governments can plan and execute programmes tailored to local needs, improving service delivery and citizen participation.

- •Reducing State Dependency on the Union: Correcting the Vertical Fiscal Imbalance through higher tax devolution and rational grants will give States more autonomy to design welfare schemes, invest in infrastructure, and undertake innovations without constantly negotiating with the Union for ad hoc funds.

- •Urban Growth and Quality of Life: With adequate and well-designed funding, cities can upgrade basic infrastructure (water supply, sewage, drainage, public transport, affordable housing), tackle air and water pollution, and build climate-resilient urban systems—critical as India is one of the fastest urbanising countries.

- •Promoting Cooperative and Competitive Federalism: A transparent and formula-based system of transfers reduces political bargaining and builds trust among States. At the same time, performance-based grants can promote competitive federalism, where States and cities compete to improve governance to receive more funds.

- •Macroeconomic Stability: A well-calibrated Finance Commission award helps maintain overall fiscal stability by setting realistic targets, incentivising responsible borrowing, and aligning Union and State finances with broader goals like FRBM (Fiscal Responsibility and Budget Management) targets, sustainable debt levels, and counter-cyclical support during shocks.

- •Equity and Regional Balance: Horizontal devolution and special grants help reduce regional inequalities by directing more resources to poorer, less developed States, thereby promoting balanced regional development and national integration.

Challenges & Criticism

- •Cess and Surcharges Problem: The Union increasingly relies on cesses and surcharges (taxes on taxes) which are excluded from the divisible pool. This reduces the effective base on which States get their share, undermining the spirit of Finance Commission devolution even if the nominal percentage (like 41%) looks high.

- •Outdated Data and Population Politics: Continued reliance on the 2011 Census for population data means that rapidly growing urban areas and newly urbanising regions may be underfunded. At the same time, States that performed well in controlling population fear being penalised by population-linked formulae, creating political tension.

- •Conditionalities vs State Autonomy: While performance- and reform-linked grants can be useful, too many conditions attached to grants may infringe on States’ policy flexibility and create administrative burden, especially for smaller or resource-poor States.

- •Balancing Fiscal Discipline with Welfare Needs: The Finance Commission must reconcile the need for fiscal prudence (limiting deficits and debt under FRBM-type norms) with the need for States to spend on health, education, nutrition, employment schemes and climate adaptation. If norms are too tight, development spending may suffer; if too loose, macro-stability may be threatened.

- •Weak Implementation of State Finance Commissions: Even if the Union FC recommends strong local body transfers, the effectiveness depends on States constituting State Finance Commissions on time, accepting their recommendations, and actually releasing funds to local bodies. In many States, SFC reports are delayed, ignored or only partially implemented.

- •Capacity Constraints at Local Level: Panchayats and ULBs often lack adequate staff, technical expertise, and systems for planning, budgeting, accounting and auditing. Without capacity building, higher transfers may not automatically translate into better outcomes.

- •Political Economy of Devolution: Any change in the devolution formula creates 'winners' and 'losers' among States. Negotiating these tensions—especially between high-income and low-income States—makes Finance Commission recommendations politically sensitive and sometimes controversial.

Future Outlook

- •Higher and More Predictable Devolution: Increasing the States’ share of the divisible pool (e.g., towards around 49% as demanded by some) and ensuring stable multi-year projections can help States plan long-term investments rather than relying on unpredictable discretionary transfers.

- •Rationalising Cesses and Surcharges: Options include: (i) limiting the use and duration of cesses/surcharges, (ii) bringing some or all of them into the divisible pool, or (iii) designing a transparent framework for sharing their proceeds with States.

- •City- and Panchayat-Specific Performance Grants: Moving beyond generic local body grants to performance-based incentives for cities and villages that improve property tax coverage, user charge collection, digital accounting, climate resilience, sanitation outcomes and citizen participation.

- •Permanent Finance Commission Secretariat: Creating a small but permanent secretariat with data, research and monitoring capabilities can help ensure continuity between Commissions, track implementation, and provide States with better analytical support.

- •Integrating Climate and SDG Financing: Future Finance Commissions are likely to embed climate adaptation, disaster resilience and Sustainable Development Goals (SDGs) into grant design, rewarding States and local bodies that invest in green infrastructure, resilient agriculture and low-carbon urban development.

- •Deeper Local Empowerment: Over the long term, empowering local governments will require not just higher transfers but also giving them stable own-tax sources (e.g., robust property tax, local fees), stronger State Finance Commissions, and legal protections to prevent arbitrary diversion or delay of funds.

- •Data-Driven Fiscal Federalism: Better data on municipal finances, panchayat accounts, service delivery outcomes and climate risks will allow future FCs to design more granular, targeted and evidence-based recommendations.

UPSC Relevance

- • GS-2 (Polity & Governance): Constitutional Bodies (Finance Commission), Devolution of powers and finances to local levels, cooperative and competitive federalism.

- • GS-3 (Economy): Government budgeting, resource mobilisation, fiscal deficit, issues of Centre–State financial relations, local governance finance.

- • GS-1 (Indian Society/Urbanisation): Challenges of rapid urbanisation, role of ULBs in planning and service delivery.

- • Prelims: Article 280, composition and qualifications of FC members, basic functions, difference between tax devolution and grants.

- • Important for questions on federal finance, State finances, role of local bodies, and concepts like VFI and horizontal imbalance.

- • Conceptual clarity on FC vs GST Council vs Finance Ministry.

- • Numerical/analytical questions on devolution percentages and grant types may also be asked.

Sample Questions

Prelims

With reference to the Finance Commission of India, consider the following statements:

1. It is constituted by the President of India under Article 280 of the Constitution.

2. Its recommendations on tax devolution between the Union and the States are legally binding.

3. It recommends the distribution of the net proceeds of taxes between the Union and the States.

4. It recommends measures to augment the Consolidated Fund of a State to supplement the resources of Panchayats and Municipalities.

Answer: Option 1, Option 3, Option 4

Explanation: Statements 1, 3 and 4 are correct. Statement 2 is incorrect because Finance Commission recommendations are advisory in nature, though they are normally accepted by the government.

Mains

“The 16th Finance Commission has the challenging task of bridging the Vertical Fiscal Imbalance while ensuring the financial sustainability of Urban Local Bodies.” Discuss.

Introduction: Introduce the Finance Commission as a constitutional body under Article 280 and briefly define Vertical Fiscal Imbalance (VFI).

Body:

• Explaining VFI: States undertake a larger share of public expenditure while the Union enjoys a larger share of tax revenues; hence the need for periodic FC awards to correct this mismatch.

• ULB and Panchayat Crisis: Under-funded and under-powered local bodies; weak property tax systems, low user charges, post-GST revenue loss, and dependence on ad hoc grants; delayed Census data further distorts allocations.

• Role of the 16th FC: Revisit vertical devolution (e.g., debate on raising share from 41% to ~49%); redesign horizontal devolution criteria; create robust, predictable local body grants, including performance-based incentives for better revenue mobilisation and governance.

• Balancing Fiscal Discipline: Discuss how the FC must balance higher devolution and expanded grants with concerns of fiscal deficit, debt sustainability, and adherence to FRBM objectives; importance of encouraging States and local bodies to strengthen their own revenue bases.

Conclusion: Conclude that a forward-looking 16th Finance Commission, if it meaningfully empowers States and local governments while preserving macroeconomic stability, can turn ‘cooperative federalism’ from a slogan into an operational reality and make India’s fiscal federal architecture more resilient and inclusive.