India’s Tea Sector - Opportunities & Challenges

India is the second-largest producer and consumer of tea and the third-largest exporter. With ~1.303 billion kg production (2024), a large domestic market and iconic regional brands like Darjeeling and Assam, India can move up the value chain by focusing on quality, branding, climate resilience and support for small tea growers.

Introduction

Context & Background

Key Points

- •Scale & Geography: India produced about 1.303 billion kg of tea in 2024. Major producing states are Assam, West Bengal (Darjeeling), Tamil Nadu (Nilgiris), Kerala and Karnataka. Several North-eastern and Himalayan states (Tripura, Arunachal, Meghalaya, Sikkim) also contribute.

- •Domestic Demand: India consumes ~1.22 billion kg (≈17% of global demand). Per-capita consumption is ~840 g/year — rising incomes and urbanisation are pushing demand for premium and packaged teas.

- •Exports & Value: India exported ~255 million kg of tea worth about US$800 million. By comparison, Sri Lanka exported similar volumes but earned higher value (≈US$1.4 billion) due to stronger branding and specialty market presence.

- •Types of Tea: Orthodox (specialty whole-leaf teas like Darjeeling), CTC (Crush–Tear–Curl — bulk, used in tea bags), green, white, flavoured, organic and instant teas. India is strong in CTC volumes but under-exposed in high-value orthodox and speciality segments.

- •Employment: The sector provides direct and indirect employment to over 1.2 million workers — many women — across plantations, smallholdings, processing factories and logistics.

- •GI & Brand Advantage: Darjeeling Tea has a Geographical Indication (GI) tag (India’s first), which helps protect origin-linked quality and supports premium pricing when marketed well.

- •Comparative Landscape: China consumes much domestically, Kenya is the largest exporter (focus on bulk), and Sri Lanka earns higher per-unit value through branding and orthodox teas. India can combine scale with improved branding to capture higher margins.

- •Beginner analogy: If bulk CTC tea is like selling raw cotton, specialty Darjeeling or organic tea is like selling a designer shirt — the price difference comes from processing, branding and quality assurance.

Quick Stats — India’s Tea (2024 snapshot)

| Indicator | Figure | Bookmark |

|---|---|---|

| Total production | 1.303 billion kg | |

| Domestic consumption | 1.22 billion kg | |

| Exports | 255 million kg (~US$800 million) | |

| Top producing states | Assam, West Bengal, Tamil Nadu, Kerala, Karnataka | |

| Workers employed | ≈1.2 million (direct & indirect) |

Tea Types & Market Position (Simple)

| Type | What it is | Market value | Bookmark |

|---|---|---|---|

| CTC (bulk) | Mechanised, used for tea bags and mass-market tea | Low unit value, high volume | |

| Orthodox (specialty) | Whole-leaf traditional processing (e.g., Darjeeling) | High unit value, niche market | |

| Green & White | Less oxidised, health positioning | Growing demand, premium pricing | |

| Organic & Flavoured | Value-added, certification needed | Premium segments, export potential |

Related Entities

Impact & Significance

- •Livelihoods: Tea supports large rural populations — plantation workers, smallholders, packers, transporters and auction markets. Improvements in the sector directly raise rural incomes and women’s employment.

- •Export earnings: By upgrading to branded, value-added teas, India can increase foreign exchange receipts — a small rise in per-kg realisation can add substantially to agro-exports.

- •Rural development & clusters: Strong tea hubs create local economies — schools, hospitals, markets — around plantations and processing units.

- •Soft power & culture: Iconic teas like Darjeeling carry cultural cachet and can be used in diplomatic and cultural outreach (tea tourism, exhibitions).

- •Supply-chain resilience: Developing small tea growers and integrating them into value chains increases overall sector resilience and spreads benefits beyond large estates.

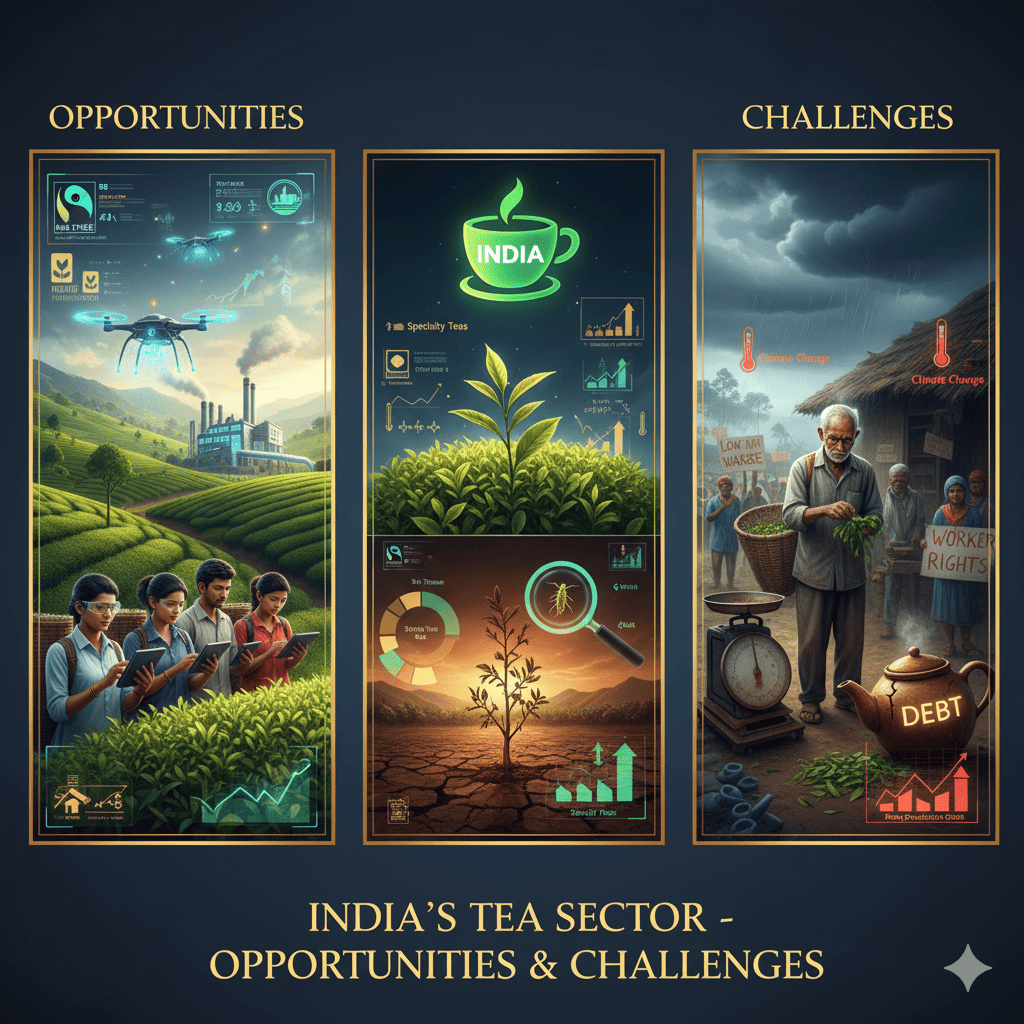

Challenges & Criticism

- •Low Value Realisation: India exports large volumes but earns lower per-kg prices due to bulk, unbranded shipments and weak packaging — limiting foreign exchange potential.

- •Over-reliance on CTC: Heavy focus on CTC (bulk) reduces focus on high-margin orthodox and speciality teas where global premiums exist.

- •Productivity Constraints: Ageing tea bushes, low levels of scientific rejuvenation, poor fertiliser & pest management practices and limited mechanisation in hilly gardens reduce yields.

- •Labour Issues: High labour intensity and rising labour costs squeeze margins. Plantation worker welfare (housing, health) remains a concern affecting productivity and social sustainability.

- •Climate Change: Erratic rainfall, rising temperatures, pests and changing seasons affect both yield and quality — especially for delicate orthodox teas.

- •Small Tea Growers (STGs) Challenges: Many STGs are marginal, lack access to credit, processing facilities and organised marketing; they often sell green leaf to middlemen at low prices.

- •Infrastructure & Standards: Weak processing standards, inconsistent grading, inadequate cold storage for value-added teas and limited export-quality packaging reduce competitiveness.

- •Market Competition: Kenya is a low-cost bulk supplier; Sri Lanka and China more effectively market premium and orthodox teas. India needs strategic branding to compete.

- •Fragmented Value Chain: Disconnected linkages between growers, factories, auctions and exporters lead to information asymmetry and value leakage.

UPSC Relevance

- • GS-3: Agriculture — plantation crops, agro-processing, rural employment and export promotion.

- • GS-2: Institutional support, social welfare of plantation workers, and rural governance.

- • Essay: Value chains, branding, sustainable agriculture and soft power diplomacy.

Sample Questions

Prelims

With reference to India’s tea industry, consider the following statements:

1. India is the largest producer of tea in the world.

2. Darjeeling Tea has a Geographical Indication (GI) tag.

3. CTC tea refers to a processing method used primarily for mass-market tea bags.

Answer: Option 2, Option 3

Explanation: Statement 1 is incorrect — China is the largest producer. Statements 2 and 3 are correct.

Mains

Examine the strengths and weaknesses of India’s tea sector. Discuss policy measures needed to increase value realisation for growers and exporters while ensuring social and environmental sustainability.

Introduction: India’s tea sector has scale, regional iconic brands and a large domestic market but earns relatively low export value due to bulk exports and weak branding.

Body:

• Strengths: Large production base, established regions (Assam, Darjeeling, Nilgiris), strong domestic consumption and employment generation.

• Weaknesses: Low per-kg realisation, dependence on CTC bulk exports, productivity & ageing bushes, climate vulnerability and smallholder fragmentation.

• Policy measures: Promote value addition and branding (GI leverage), support STGs via aggregation and FPOs, invest in R&D & climate-resilient varieties, improve processing and packaging, and strengthen worker welfare & labour reforms.

Conclusion: A targeted strategy combining product diversification, brand-building, smallholder support and climate adaptation can help India capture higher value and emerge as a global leader in the tea industry.