Rising Debt on Indian States: Fiscal Sustainability Concerns

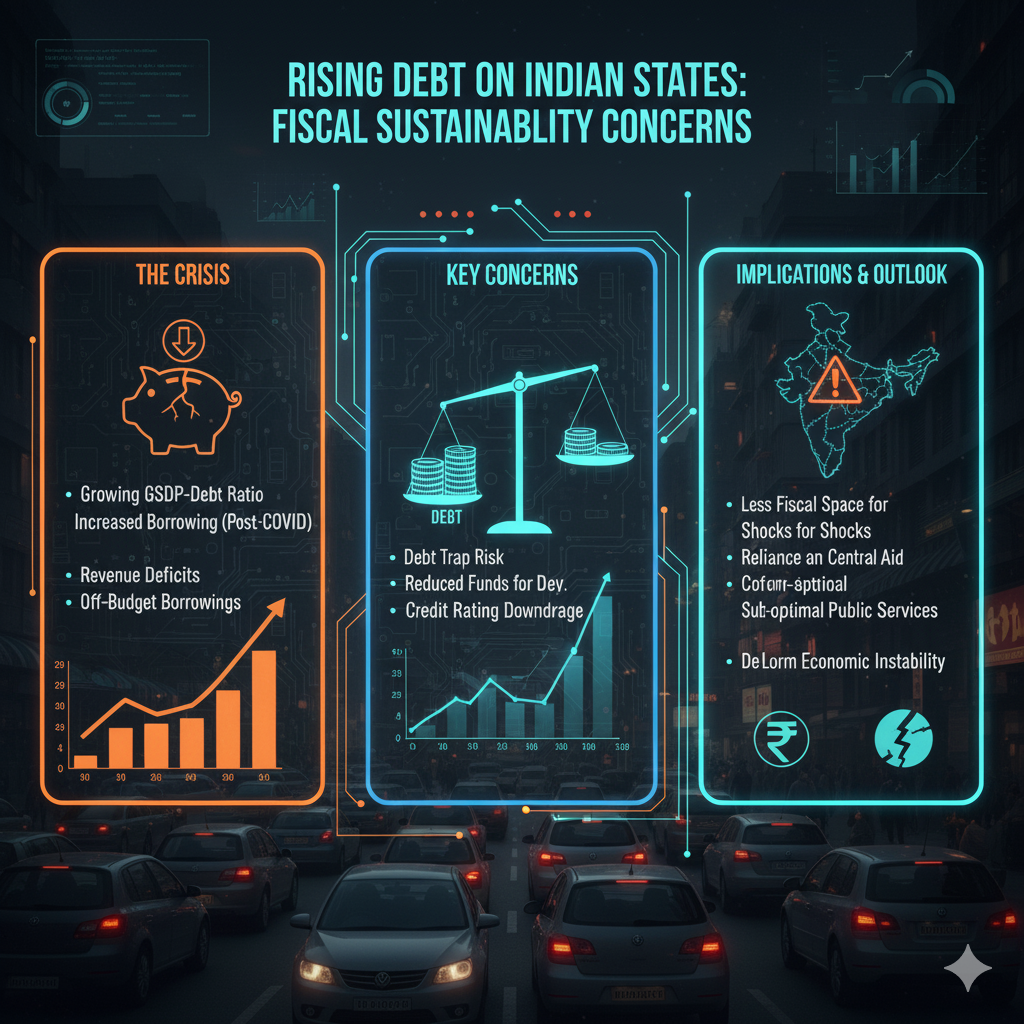

CAG’s 10-year fiscal analysis shows that Indian states' debt has tripled in a decade, breaching fiscal prudence norms and raising sustainability concerns. High revenue expenditure, subsidy load, GST compensation expiry, and post-COVID stress have worsened debt dynamics.

Introduction

India’s states are experiencing a sharp rise in public debt, raising concerns about long-term fiscal sustainability, federal fiscal balance and developmental spending capacity. Public debt has become a key macroeconomic issue as states bridge welfare commitments, post-pandemic recovery needs and infrastructure demands.

Context & Background

A decade-long CAG study (2013-14 → 2022-23) shows state debt rising over 3.39x, breaching FRBM norms in several cases. With GST compensation ending, welfare pressures rising and revenue bases uneven, states may face a potential sub-national debt crisis risk if corrective policy isn't pursued.

Key Points

- •Debt Expansion: State debt rose from ₹17.57 lakh crore → ₹59.6 lakh crore in 10 years, burdening future fiscal space.

- •Debt-to-GSDP Pressure: Jump from 16.66% (2013-14) to 22.96% (2022-23), exceeding recommended 20% threshold.

- •Golden Rule Violation: Borrowing increasingly used for revenue expenditure instead of capital creation, weakening growth multiplier impact.

- •Dependence on Central Transfers: Weak own-tax capacity → heavy reliance on GST compensation, central schemes, and back-to-back loans.

- •Post-COVID Fiscal Stress: Revenue collapse + welfare surge → expansion in committed expenditure and debt rollover burden.

- •Freebies & Populism: Competitive subsidies (electricity, farm waivers, social transfers) strain fiscal health, especially in Punjab, AP, Rajasthan.

- •Interest Burden: Rising interest-to-revenue ratio crowds out public investment & human capital spending.

- •High Inter-State Variance: Punjab, WB, Nagaland cross 30–40% debt-GSDP; Odisha & Maharashtra maintain prudent paths.

- •Macro Spillovers: State debt now ~30% of general govt debt → sovereign rating sensitivity & bond market pressure.

- •Institutional Gaps: Lack of State Debt Management Cells and weak medium-term debt strategies reduce fiscal accountability.

- •Fiscal Federalism Debate: Calls for revisiting borrowing limits, GST compensation model, and cooperative fiscal design.

Related Entities

Impact & Significance

- •Crowding out of Capex: Revenue pressure limits infrastructure spending and human capital investment.

- •Lower Growth Potential: Debt diversion weakens state development capacity → long-run growth trade-off.

- •Threat to Inter-Generational Equity: Debt burden passed to future taxpayers without proportional asset creation.

- •Credit Rating Risks: Sub-national debt stress could influence sovereign risk outlook.

- •Weak Welfare Delivery: Fiscal compression threatens health, education, and rural spending.

Challenges & Criticism

- •Freebies vs Development Trade-off: Welfare schemes without asset-backing stress fiscal health.

- •GST Compensation Expiry: Revenue shock to low-capacity states increases vulnerability.

- •Weak Revenue Mobilisation: Property tax, mining royalties, and excise remain under-leveraged.

- •Opaque Guarantees: Off-budget borrowings and contingent liabilities create hidden fiscal risks.

Future Outlook

- •Shift toward fiscal discipline reforms with FRBM tightening.

- •Digitalisation of state tax systems to enhance compliance.

- •Push for performance-linked transfers, DBT-based welfare.

- •Development of municipal bonds & PPP financing pipelines.

- •Institutionalising State Fiscal Councils and Debt Cells.

UPSC Relevance

- • GS-3: Budgeting, Fiscal Policy, Federal Finances, Debt Sustainability

- • GS-2: Centre-State Relations, Finance Commission

- • Essay: Welfare vs Fiscal Prudence, Cooperative federalism & fiscal sustainability

Sample Questions

Prelims

Consider the following statements regarding rising state debt in India: 1) Debt-to-GSDP ratio for Indian states has remained below 15% since 2014. 2) Borrowings should be used primarily for capital expenditure as per fiscal norms. Which of the above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Answer: Option B

Explanation: Statement 1 is incorrect — the ratio has risen above 22%. Statement 2 is correct — golden rule of public finance.

Mains

Rising public debt among Indian states poses a long-term challenge to fiscal stability and developmental spending. Discuss the causes, implications and reform pathways.

Introduction:

State debt in India has grown significantly post-pandemic driven by revenue stress, welfare spending and weak tax buoyancy. This raises issues of fiscal sustainability and cooperative federalism.

Body:

• Causes: GST compensation expiry, post-COVID revenue shock, rising subsidies/freebies, interest burden, FRBM relaxation, political populism.

• Implications: Capex crowding-out, inter-generational fiscal burden, sovereign credit sensitivity, federal friction, social sector squeeze.

• Reforms: Debt management cells, rationalised subsidies, broadening tax base, independent fiscal council, outcome-based budgeting, PPP models, better own revenue mobilisation.

Conclusion:

Balancing welfare needs and fiscal prudence requires strengthening federal fiscal frameworks, improving tax systems, and ensuring accountable and productive use of debt.