Economics Playlist

18 chapters • 0 completed

Introduction to Economics

10 topics

National Income

17 topics

Inclusive growth

15 topics

Inflation

21 topics

Money

15 topics

Banking

38 topics

Monetary Policy

15 topics

Investment Models

9 topics

Food Processing Industries

9 topics

Taxation

28 topics

Budgeting and Fiscal Policy

24 topics

Financial Market

34 topics

External Sector

37 topics

Industries

21 topics

Land Reforms in India

16 topics

Poverty, Hunger and Inequality

24 topics

Planning in India

16 topics

Unemployment

17 topics

Chapter 10: Taxation

Chapter TestTaxation

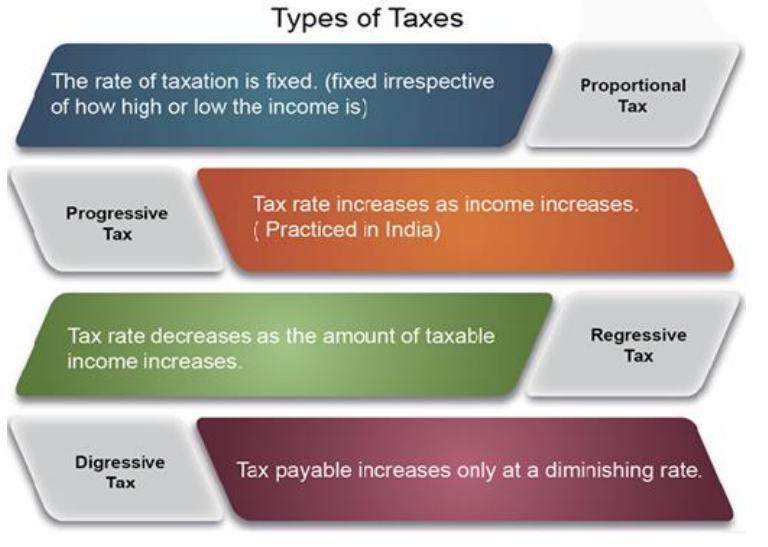

Taxation is the system by which governments collect money from individuals, businesses, and organizations in the form of taxes to fund public services and development. Taxes are compulsory payments used not only for revenue but also as tools of fiscal policy to control inflation, promote growth, and ensure social welfare.

Taxation is the system by which governments collect money from individuals, businesses, and organizations in the form of taxes to fund public services and development. Taxes are compulsory payments used not only for revenue but also as tools of fiscal policy to control inflation, promote growth, and ensure social welfare.

Comparison: Direct vs Indirect Taxes

| Parameter | Direct Tax | Indirect Tax |

|---|---|---|

| Meaning | Tax on income/wealth paid directly to govt. | Tax on goods/services, collected indirectly |

| Incidence & Impact | Falls on same person | Falls on different persons (consumer pays, seller deposits) |

| Tax Base | Income, profits, wealth | Consumption, sales, production |

| Evasion | Possible | Hardly possible |

| Effect on Inflation | Helps in controlling inflation | Can push prices up (inflationary) |

| Burden | Cannot be shifted | Can be shifted |

Mains Key Points

Prelims Strategy Tips

Taxation in India

In India, taxes are levied at three levels – by the Central Government, the State Governments, and local authorities (like Panchayats and Municipalities). The Constitution of India provides the framework for taxation through specific Articles and Schedules.

In India, taxes are levied at three levels – by the Central Government, the State Governments, and local authorities (like Panchayats and Municipalities). The Constitution of India provides the framework for taxation through specific Articles and Schedules.

Direct Taxes: Union vs State Government

| Category | Union Government | State Government |

|---|---|---|

| On Income | Corporate Tax, Personal Income Tax, MAT, Capital Gains Tax | Agriculture Tax, Professional Tax |

| On Expenditure | Fringe Benefit Tax (abolished), Gift Tax (abolished) | Road Tax |

| On Assets | Securities Transaction Tax, Wealth Tax (abolished) | Land Revenue, Stamp Duty, Property Tax |

Mains Key Points

Prelims Strategy Tips

Personal Income Tax in India

Personal Income Tax is a tax imposed by the government on the income earned by individuals. It is governed by the Income Tax Act, 1961, and is a major source of government revenue. In India, there are two regimes: the Old Tax Regime (with exemptions and deductions) and the New Tax Regime (simplified slabs, fewer exemptions).

Personal Income Tax is a tax imposed by the government on the income earned by individuals. It is governed by the Income Tax Act, 1961, and is a major source of government revenue. In India, there are two regimes: the Old Tax Regime (with exemptions and deductions) and the New Tax Regime (simplified slabs, fewer exemptions).

Old vs New Tax Regime (FY 2025-26)

| Aspect | Old Regime | New Regime (2025 onwards) |

|---|---|---|

| Basic Exemption Limit | ₹2.5–5 lakh (depending on age) | ₹4 lakh (all categories) |

| Slab rates | 5%, 20%, 30% (depending on income brackets) | 5%, 10%, 15%, 20%, 25%, 30% (more granular) |

| Rebate (87A) | Up to ₹5 lakh income → Nil tax | Up to ₹12 lakh income → Nil tax |

| Exemptions/Deductions | Available (80C, 80D, HRA, etc.) | Mostly not available |

| Default Status | Opt-in | Default regime for individuals/HUFs |

Mains Key Points

Prelims Strategy Tips

Corporate Tax in India

Corporate Tax is the tax levied on the net profits of companies. It applies to both Indian (domestic) companies and foreign companies earning income in India. It is one of the major direct taxes in India, governed by the Income Tax Act, 1961. Over time, reforms have been introduced to reduce rates, simplify compliance, and make India an attractive destination for business and foreign investment.

Corporate Tax is the tax levied on the net profits of companies. It applies to both Indian (domestic) companies and foreign companies earning income in India. It is one of the major direct taxes in India, governed by the Income Tax Act, 1961. Over time, reforms have been introduced to reduce rates, simplify compliance, and make India an attractive destination for business and foreign investment.

Corporate Tax Rates in India (Domestic vs Foreign Companies)

| Type of Company | Tax Rate | Special Notes |

|---|---|---|

| Domestic (No Exemptions) | 22% + cess/surcharge | Effective 25.17%, No MAT |

| Domestic (With Exemptions) | 30% | MAT at 15% applies |

| New Manufacturing Companies (post 1 Oct 2019) | 15% | Fresh investment needed |

| Foreign Company (Any Income) | 40% | Income from India operations |

| Foreign Company (Royalty/Tech fees pre-1976) | 50% | If approved by Govt. |

Mains Key Points

Prelims Strategy Tips

Capital Gains Tax

Capital Gains Tax is the tax imposed on profits earned from the sale of capital assets such as land, property, jewellery, shares, bonds, and other securities. It is categorized into Short-Term Capital Gains (STCG) and Long-Term Capital Gains (LTCG) depending on how long the asset was held.

Capital Gains Tax is the tax imposed on profits earned from the sale of capital assets such as land, property, jewellery, shares, bonds, and other securities. It is categorized into Short-Term Capital Gains (STCG) and Long-Term Capital Gains (LTCG) depending on how long the asset was held.

Types of Capital Gains Tax

| Type | Holding Period | Tax Rate |

|---|---|---|

| Short-Term Capital Gain (STCG) | ≤ 36 months (≤24 for immovable property, ≤12 for shares/securities) | As per income tax slab; 15% flat for listed shares with STT |

| Long-Term Capital Gain (LTCG) | > 36 months (>24 immovable property, >12 shares/securities) | 10% (equity above ₹1 lakh, no indexation); 20% with indexation for other assets |

| Securities Transaction Tax (STT) | Applied on purchase/sale at stock exchange | Small % on transaction value |

| Digital Tax (Equalisation Levy) | Applicable on foreign e-commerce & digital services | 6% (ads, 2016); 2% (e-commerce, 2020 onwards) |

Mains Key Points

Prelims Strategy Tips

Professional Tax, Fringe Benefit Tax, BCTT and Virtual Digital Asset Taxation

These taxes represent different forms of taxation in India—Professional Tax (by states), Fringe Benefit Tax and Banking Cash Transaction Tax (withdrawn), and the newly introduced Virtual Digital Asset (VDA) taxation at 30%.

These taxes represent different forms of taxation in India—Professional Tax (by states), Fringe Benefit Tax and Banking Cash Transaction Tax (withdrawn), and the newly introduced Virtual Digital Asset (VDA) taxation at 30%.

Comparison of Special Taxes

| Tax | Introduced | Applicability | Current Status |

|---|---|---|---|

| Professional Tax | Constitutional provision (Art. 276) | Employees & Professionals (by States) | Active, max ₹2,500/year |

| Fringe Benefit Tax (FBT) | 2005 | Non-cash benefits given by employers | Withdrawn in 2009 |

| Banking Cash Transaction Tax (BCTT) | 2005 | Cash withdrawals > ₹25,000/day | Withdrawn in 2009 |

| Virtual Digital Asset Tax (VDA) | 2022 | Cryptocurrencies, NFTs, digital tokens | Active, 30% tax + 1% TDS |

Mains Key Points

Prelims Strategy Tips

Agricultural Income Tax

Agricultural income, as defined under Section 2(1A) of the Income Tax Act, refers to rent, revenue, or income derived from land used for agricultural purposes in India. As per Section 10(1), agricultural income is exempt from central income tax, though debates exist on whether it should be taxed.

Agricultural income, as defined under Section 2(1A) of the Income Tax Act, refers to rent, revenue, or income derived from land used for agricultural purposes in India. As per Section 10(1), agricultural income is exempt from central income tax, though debates exist on whether it should be taxed.

Agricultural Income – Key Aspects

| Aspect | Details |

|---|---|

| Definition (Sec 2(1A)) | Rent, revenue, or income from agricultural land and related activities. |

| Exemption (Sec 10(1)) | Agricultural income is fully exempt from central income tax. |

| Against Tax | Small farmers’ burden, informal sector, rural distress, low credit. |

| In Favour of Tax | Equity, prevent laundering, widen tax base, target rich farmers. |

Mains Key Points

Prelims Strategy Tips

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS)

TDS and TCS are mechanisms of advance tax collection under the Income Tax Act. TDS is deducted at the time of payment (e.g., salary, rent, contractor payments), while TCS is collected at the time of sale of specified goods (e.g., motor vehicles, tendu leaves, scrap). Both help reduce tax evasion but also bring compliance challenges.

TDS and TCS are mechanisms of advance tax collection under the Income Tax Act. TDS is deducted at the time of payment (e.g., salary, rent, contractor payments), while TCS is collected at the time of sale of specified goods (e.g., motor vehicles, tendu leaves, scrap). Both help reduce tax evasion but also bring compliance challenges.

Comparison of TDS and TCS

| Aspect | TDS | TCS |

|---|---|---|

| Timing | Deducted at time of payment | Collected at time of sale |

| Who deducts/collects? | Payer (e.g., employer, tenant, bank) | Seller of goods/services |

| Applicable on | Salary, rent, contractor fees, interest, property purchase | Motor vehicles, tendu leaves, scrap, minerals |

| Purpose | Advance tax to reduce evasion | Ensure collection on high-value goods sales |

Mains Key Points

Prelims Strategy Tips

Budget 2023–24: Reforms Proposed in Direct Taxes

The Union Budget 2023–24 introduced several reforms in Direct Taxes aimed at simplifying compliance, giving relief to co-operatives, startups, and individuals, rationalising exemptions, and making the new tax regime more attractive. Key areas include personal income tax, co-operatives, startups, capital gains, online gaming, gold transactions, IT return reforms, and targeted tax exemptions.

The Union Budget 2023–24 introduced several reforms in Direct Taxes aimed at simplifying compliance, giving relief to co-operatives, startups, and individuals, rationalising exemptions, and making the new tax regime more attractive. Key areas include personal income tax, co-operatives, startups, capital gains, online gaming, gold transactions, IT return reforms, and targeted tax exemptions.

Budget 2023–24 Direct Tax Reforms – At a Glance

| Area | Reform |

|---|---|

| Co-operatives | 15% tax rate; cash limits enhanced; sugar co-ops relief. |

| Start-Ups | Benefits extended till 31-03-2024; loss carry forward up to 10 years. |

| Capital Gains | Exemption on house purchase capped at ₹10 crore. |

| Online Gaming | No minimum threshold; winnings taxed at withdrawal or FY end. |

| Gold | Conversion to/from EGR not taxable. |

| Exemptions | Agniveer Fund EEE; statutory authorities exempt. |

| IT Return | Common form; grievance redressal improved. |

| Personal Income Tax | Rebate up to ₹7 lakh; new regime default; surcharge reduced. |

Mains Key Points

Prelims Strategy Tips

Indirect Taxes

Indirect taxes are taxes levied on goods and services rather than on income or profits. The burden of tax is shifted from producers/sellers to consumers. Examples include customs duty, excise duty, service tax, and sales tax (most of which are now subsumed under GST in India).

Indirect taxes are taxes levied on goods and services rather than on income or profits. The burden of tax is shifted from producers/sellers to consumers. Examples include customs duty, excise duty, service tax, and sales tax (most of which are now subsumed under GST in India).

Types of Indirect Taxes in India

| Tax Type | Year Introduced | Key Features | Status |

|---|---|---|---|

| Excise Duty | 1944 | Levied on manufacture/sale of goods (excl. alcohol/narcotics) | Subsumed under GST |

| Central Sales Tax (CST) | 1956 | Levied on inter-state trade | Subsumed under GST |

| Customs Duty | 1962 | Levied on imports/exports, protects domestic economy | Still in force |

| Countervailing Duty (CVD) | - | Neutralises subsidies given by foreign governments | Still in force (WTO compliant) |

| Anti-Dumping Duty | - | Protects against underpriced imports | Still in force |

| Service Tax | 1994 | Levied on services, negative list for exemptions | Subsumed under GST |

Mains Key Points

Prelims Strategy Tips

Reforms in Indirect Tax & GST

India's indirect tax system went through three major stages: MODVAT (1986), VAT (2005), and GST (2017). Each reform was aimed at reducing the problem of 'tax on tax' (cascading effect) and making the tax system simpler, fairer, and more transparent. GST is the most comprehensive reform, creating a single national market by merging multiple taxes into one.

India's indirect tax system went through three major stages: MODVAT (1986), VAT (2005), and GST (2017). Each reform was aimed at reducing the problem of 'tax on tax' (cascading effect) and making the tax system simpler, fairer, and more transparent. GST is the most comprehensive reform, creating a single national market by merging multiple taxes into one.

Stages of Indirect Tax Reforms

| Stage | Period | Key Features |

|---|---|---|

| MODVAT | 1986–2004 | Excise duty credit on raw materials; avoided double taxation |

| VAT | 2005–2017 | Tax at every stage; Input Tax Credit (ITC); state-level differences |

| GST | 2017–Present | One Nation One Tax; destination-based; merged multiple taxes |

Mains Key Points

Prelims Strategy Tips

Goods and Services Tax (GST) in India

GST is a comprehensive, destination-based indirect tax introduced in 2017 by the 101st Constitutional Amendment. It subsumed multiple central and state taxes into one uniform system, creating 'One Nation, One Tax, One Market'. The GST Council, a constitutional body under Article 279A, decides GST rates and policies. However, the Supreme Court has clarified that its recommendations are not legally binding.

GST is a comprehensive, destination-based indirect tax introduced in 2017 by the 101st Constitutional Amendment. It subsumed multiple central and state taxes into one uniform system, creating 'One Nation, One Tax, One Market'. The GST Council, a constitutional body under Article 279A, decides GST rates and policies. However, the Supreme Court has clarified that its recommendations are not legally binding.

GST Key Aspects

| Aspect | Details |

|---|---|

| Year of Implementation | 2017 (101st Amendment Act) |

| Taxes Subsumed | Excise Duty, Service Tax, VAT, Octroi, Luxury Tax, etc. |

| Rates | 0%, 5%, 12%, 18%, 28% |

| Outside GST | Petrol, Diesel, ATF, Alcohol, Electricity, Natural Gas |

| Decision Making Body | GST Council (Article 279A) |

| Supreme Court Stand | Council's recommendations are persuasive, not binding |

Mains Key Points

Prelims Strategy Tips

E-Way Bill and GST (Compensation to States) Act, 2017

The E-Way Bill is a digital document required for the transportation of goods worth over ₹50,000, aimed at ensuring smooth, transparent, and traceable movement of goods across India. The GST Compensation to States Act, 2017 was introduced to assure states that any revenue losses due to GST implementation would be compensated for five years through a special compensation cess.

The E-Way Bill is a digital document required for the transportation of goods worth over ₹50,000, aimed at ensuring smooth, transparent, and traceable movement of goods across India. The GST Compensation to States Act, 2017 was introduced to assure states that any revenue losses due to GST implementation would be compensated for five years through a special compensation cess.

E-Way Bill and GST Compensation – Key Aspects

| Aspect | Details |

|---|---|

| E-Way Bill Requirement | Mandatory for goods worth > ₹50,000, with QR code for quick inspection |

| E-Way Bill Exemption | Not needed for non-motor transport (rickshaw, bicycle, etc.) |

| GST Compensation Period | 5 years (2017–2022) from GST introduction |

| Funding Mechanism | Compensation Cess on luxury & harmful goods (tobacco, aerated drinks, cars) |

| Challenge | Revenue shortfalls, delayed payments, Centre-State disputes |

Mains Key Points

Prelims Strategy Tips

IT Infrastructure for GST Implementation

For smooth GST implementation in India, several digital and institutional mechanisms were created such as Goods and Services Tax Network (GSTN), Project Saksham, Input Tax Credit system, National Anti-Profiteering Authority (NAA), and Authority for Advance Ruling (AAR). These ensure transparency, efficiency, and fairness in tax administration.

For smooth GST implementation in India, several digital and institutional mechanisms were created such as Goods and Services Tax Network (GSTN), Project Saksham, Input Tax Credit system, National Anti-Profiteering Authority (NAA), and Authority for Advance Ruling (AAR). These ensure transparency, efficiency, and fairness in tax administration.

Key IT and Institutional Mechanisms for GST

| Mechanism | Purpose |

|---|---|

| GSTN | IT backbone for registration, payment, returns, and invoice tracking |

| Project Saksham | CBIC’s IT modernization and integration with GSTN + SWIFT |

| Input Tax Credit | Avoids double taxation by adjusting input tax against output tax |

| NAA | Ensures benefits of tax reduction/ITC are passed to consumers |

| AAR | Provides clarity and advance certainty on GST liability |

Mains Key Points

Prelims Strategy Tips

Benefits and Challenges of GST

The Goods and Services Tax (GST), implemented in 2017, is a landmark reform that replaced multiple indirect taxes with a unified system. It has created a common national market, removed cascading of taxes, and increased transparency. However, issues like revenue concerns of states, multiple tax slabs, and the need for stronger grievance mechanisms remain.

The Goods and Services Tax (GST), implemented in 2017, is a landmark reform that replaced multiple indirect taxes with a unified system. It has created a common national market, removed cascading of taxes, and increased transparency. However, issues like revenue concerns of states, multiple tax slabs, and the need for stronger grievance mechanisms remain.

GST – Benefits vs Challenges

| Aspect | Benefits | Challenges |

|---|---|---|

| Economic Impact | Unified market, reduced inflation | Revenue loss for states, high compliance cost |

| Taxation System | Simplified one-tax system | Multiplicity of slabs, exemptions weaken uniformity |

| Governance | Cooperative federalism via GST Council | Centre's power to alter rates reduces Parliament’s role |

| Consumer Protection | Anti-profiteering laws to reduce prices | Complex and weak enforcement |

| Logistics | Smooth transport, reduced costs | Some sectors excluded, creating distortions |

Mains Key Points

Prelims Strategy Tips

Budget 2023 – Reforms in Indirect Taxes

The Union Budget 2023 introduced key reforms in indirect taxation, focusing on legislative changes in Customs and GST laws, and sector-specific reforms to promote green mobility, electronics, marine exports, lab-grown diamonds, and precious metals. The aim is to simplify compliance, encourage domestic manufacturing, and boost export competitiveness.

The Union Budget 2023 introduced key reforms in indirect taxation, focusing on legislative changes in Customs and GST laws, and sector-specific reforms to promote green mobility, electronics, marine exports, lab-grown diamonds, and precious metals. The aim is to simplify compliance, encourage domestic manufacturing, and boost export competitiveness.

Budget 2023 Indirect Tax Reforms – Sector-wise

| Sector | Reform |

|---|---|

| Green Mobility | Excise duty exemption on biogas; customs duty exemption on EV battery machinery |

| Electronics | Duty relief on camera lenses, lithium-ion cells; TV panel parts at 2.5% |

| Electricals | Chimney duty raised to 15%; heat coils reduced to 15% |

| Marine Products | Duty cut on inputs for shrimp feed to boost exports |

| Lab-Grown Diamonds | Duty cut on diamond seeds |

| Precious Metals | Increased duty on gold, platinum, silver imports |

| Metals | Exemption continued on raw materials like CRGO steel, nickel cathode |

| Compounded Rubber | Duty hiked from 10% to 25% |

| Cigarettes | NCCD increased on specified cigarettes |

Mains Key Points

Prelims Strategy Tips

Concepts Related to Taxation – Tax to GDP Ratio

The Tax-to-GDP ratio measures the total tax collected by the government as a percentage of the country’s Gross Domestic Product (GDP). It shows the government’s ability to raise resources for spending on development, infrastructure, and welfare without over-reliance on borrowing.

The Tax-to-GDP ratio measures the total tax collected by the government as a percentage of the country’s Gross Domestic Product (GDP). It shows the government’s ability to raise resources for spending on development, infrastructure, and welfare without over-reliance on borrowing.

Tax-to-GDP Ratio – International Comparison

| Country | Tax-to-GDP Ratio |

|---|---|

| India | 10–12% |

| China | 17–20% |

| Brazil | 33%+ |

| OECD Countries (average) | 34%+ |

| World Bank Threshold | 15% (minimum for growth) |

Mains Key Points

Prelims Strategy Tips

Measures to Increase Tax-to-GDP Ratio

Improving India’s Tax-to-GDP ratio requires reforms in both the tax structure and the tax administration. Simplifying tax rates, cutting unnecessary exemptions, and using technology for better compliance can help expand the tax base, curb evasion, and increase government revenue.

Improving India’s Tax-to-GDP ratio requires reforms in both the tax structure and the tax administration. Simplifying tax rates, cutting unnecessary exemptions, and using technology for better compliance can help expand the tax base, curb evasion, and increase government revenue.

Key Measures to Improve Tax-to-GDP Ratio

| Measure | Explanation |

|---|---|

| Corporate Tax Cut | Lower rates encourage investment → higher long-term revenue |

| GST Implementation | Simplified structure, reduced leakage, widened base |

| Aadhaar-PAN Linkage | Better tracking and reduced tax evasion |

| Digital Tools (E-way bills, Project Insight) | Improved compliance and reduced manual corruption |

| Presumptive Taxation | Brings small taxpayers into tax net without heavy compliance burden |

Mains Key Points

Prelims Strategy Tips

Laffer Curve, Tax Buoyancy and Tax Avoidance

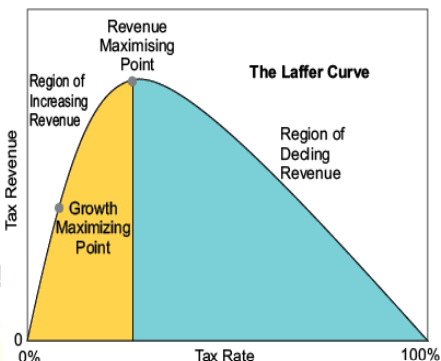

The Laffer Curve shows the relationship between tax rates and revenue, highlighting an optimal rate that maximizes revenue. Tax buoyancy measures how tax revenue grows with GDP growth. Tax avoidance refers to legally minimizing tax liability using exemptions allowed by law.

The Laffer Curve shows the relationship between tax rates and revenue, highlighting an optimal rate that maximizes revenue. Tax buoyancy measures how tax revenue grows with GDP growth. Tax avoidance refers to legally minimizing tax liability using exemptions allowed by law.

Comparison: Laffer Curve, Tax Buoyancy & Tax Avoidance

| Concept | Meaning | Impact |

|---|---|---|

| Laffer Curve | Shows link between tax rate and revenue (inverted U). | Helps decide optimal tax rate to maximize revenue. |

| Tax Buoyancy | Measures how tax revenue grows with GDP growth. | Shows efficiency of tax system without changing rates. |

| Tax Avoidance | Legal reduction of tax liability using exemptions. | Reduces effective tax revenue but is not illegal. |

Mains Key Points

Prelims Strategy Tips

Tax Evasion

Tax evasion is an illegal practice where individuals or businesses deliberately avoid paying their taxes using fraudulent methods like hiding income, inflating expenses, or submitting false returns. It is a punishable crime that harms the economy by reducing government revenue and increasing black money.

Tax evasion is an illegal practice where individuals or businesses deliberately avoid paying their taxes using fraudulent methods like hiding income, inflating expenses, or submitting false returns. It is a punishable crime that harms the economy by reducing government revenue and increasing black money.

Difference between Tax Avoidance and Tax Evasion

| Aspect | Tax Avoidance | Tax Evasion |

|---|---|---|

| Legality | Legal (uses loopholes in law) | Illegal (against the law) |

| Method | Planned use of exemptions/deductions | Fraudulent hiding of income/false returns |

| Consequence | No punishment (but govt may plug loopholes) | Punishable with fines and imprisonment |

| Impact | Reduces tax liability legally | Causes loss to government revenue |

Mains Key Points

Prelims Strategy Tips

Black Money

Black money refers to income that is not reported to tax authorities. It can come from both legal activities (like under-reporting shop income) and illegal activities (like smuggling, bribery, or hawala). It causes revenue loss, fuels corruption, and weakens the economy.

Black money refers to income that is not reported to tax authorities. It can come from both legal activities (like under-reporting shop income) and illegal activities (like smuggling, bribery, or hawala). It causes revenue loss, fuels corruption, and weakens the economy.

Major Ways of Generating Black Money

| Method | Explanation |

|---|---|

| Hawala System | Informal money transfer outside banks, avoiding tax. |

| Round Tripping | Money routed abroad and brought back as foreign investment. |

| P-Notes | Anonymous financial instruments used by foreign investors. |

| DTAA Misuse | Using tax treaties with countries like Mauritius to reduce tax liability. |

| Tax Havens | Countries with very low or zero taxes used to hide money. |

| Gold/Property Investment | Buying assets without reporting them to authorities. |

Mains Key Points

Prelims Strategy Tips

Black Money

Black Money refers to any income or wealth that is hidden from the government and not reported for tax purposes. It can be generated from legal sources (like under-reporting income from a shop or business) or illegal sources (like smuggling, corruption, drug trade, hawala). It harms the economy by reducing government revenue, increasing corruption, and widening inequality.

Black Money refers to any income or wealth that is hidden from the government and not reported for tax purposes. It can be generated from legal sources (like under-reporting income from a shop or business) or illegal sources (like smuggling, corruption, drug trade, hawala). It harms the economy by reducing government revenue, increasing corruption, and widening inequality.

Major Ways of Generating Black Money

| Method | Explanation |

|---|---|

| Hawala System | Money transfer without banks to avoid taxes, based on trust. |

| Round Tripping | Money sent abroad and returned as 'foreign investment'. |

| P-Notes | Anonymous investment tools for foreigners, often misused. |

| DTAA Misuse | Using tax treaties with low-tax countries to escape Indian tax. |

| Tax Havens | Countries with little/no tax, e.g., Cayman Islands, Switzerland. |

| Asset Investment | Buying gold, real estate, or benami property secretly. |

Mains Key Points

Prelims Strategy Tips

Benami Transactions (Prohibition) Act, 2016 & Prevention of Money Laundering Act, 2002

The Benami Transactions (Prohibition) Act, 2016 aims to prevent people from hiding wealth in the name of others (benami transactions) to avoid taxes, while the Prevention of Money Laundering Act (PMLA), 2002 prevents and punishes money laundering activities, where illegally earned money is shown as legal.

The Benami Transactions (Prohibition) Act, 2016 aims to prevent people from hiding wealth in the name of others (benami transactions) to avoid taxes, while the Prevention of Money Laundering Act (PMLA), 2002 prevents and punishes money laundering activities, where illegally earned money is shown as legal.

Comparison of Benami Act and PMLA

| Aspect | Benami Act (2016) | PMLA (2002) |

|---|---|---|

| Purpose | Stop black money via fake ownership | Stop laundering (converting black money into white) |

| Key Authorities | Initiating Officer, Adjudicating Authority, Tribunal | ED, FIU-IND |

| Penalty | 1–7 years imprisonment + fine up to 25% of property value | 3–7 years (10 years for drugs) + fine |

| Key Concept | Benamidar holds property for real owner | Money laundering = showing illegal money as legal |

| Appeal | Appellate Tribunal → High Court | Special Court under PMLA |

Mains Key Points

Prelims Strategy Tips

Black Money and Imposition of Tax (Undisclosed Foreign Income and Assets) Act, 2015

This Act was introduced to penalize Indian residents who hide foreign income or assets and do not report them to tax authorities. It imposes strict taxes, heavy penalties, and even imprisonment for evading taxes on foreign income and property.

This Act was introduced to penalize Indian residents who hide foreign income or assets and do not report them to tax authorities. It imposes strict taxes, heavy penalties, and even imprisonment for evading taxes on foreign income and property.

Key Provisions of Black Money Act, 2015

| Aspect | Details |

|---|---|

| Tax Rate | Flat 30% on undisclosed foreign income/assets |

| Compliance Window | One-time chance with 30% tax + 100% penalty |

| Penalty | 3x tax + fines up to ₹10 lakh or more |

| Prosecution | 3–10 years rigorous imprisonment + fine |

| Scope | Foreign income/assets not disclosed in tax returns |

Mains Key Points

Prelims Strategy Tips

Tax Havens, Tax Terrorism, and Indirect Transfers

A tax haven is a country or territory that offers very low or zero taxes to foreign individuals or corporations, often allowing them to avoid paying taxes in their home country. India has also faced issues such as tax terrorism (retrospective taxation) and indirect transfers of assets, leading to landmark disputes like the Vodafone case.

A tax haven is a country or territory that offers very low or zero taxes to foreign individuals or corporations, often allowing them to avoid paying taxes in their home country. India has also faced issues such as tax terrorism (retrospective taxation) and indirect transfers of assets, leading to landmark disputes like the Vodafone case.

Comparison of Tax Haven, Tax Terrorism, and Indirect Transfer

| Concept | Meaning | Example |

|---|---|---|

| Tax Haven | Low/zero tax country for foreigners to hide profits | Cayman Islands, Mauritius |

| Countermeasure | Global laws and treaties to stop profit shifting | OECD Global Minimum Tax |

| Tax Terrorism | Unreasonable retrospective taxation by govt | Vodafone retrospective tax case |

| Indirect Transfer | Foreign share transfer indirectly linked to Indian assets | Vodafone-Cairn disputes |

Mains Key Points

Prelims Strategy Tips

Buyback Tax and Pigouvian Tax

Buyback Tax is imposed when a company repurchases its own shares, often to improve earnings per share or avoid dividend distribution tax. Pigouvian Tax is a corrective tax imposed on activities that cause negative externalities (harm to society), such as carbon emissions.

Buyback Tax is imposed when a company repurchases its own shares, often to improve earnings per share or avoid dividend distribution tax. Pigouvian Tax is a corrective tax imposed on activities that cause negative externalities (harm to society), such as carbon emissions.

Comparison Between Buyback Tax and Pigouvian Tax

| Aspect | Buyback Tax | Pigouvian Tax |

|---|---|---|

| Definition | Tax on company repurchasing its own shares | Tax on activities causing harm to society (externalities) |

| Purpose | Prevent tax avoidance, improve EPS, control takeovers | Discourage harmful activities, make polluters pay |

| Example | Share buyback by Infosys or TCS | Carbon tax on coal/oil/gas companies |

Mains Key Points

Prelims Strategy Tips

Trends in Tax Revenue Collection, APA and GAAR

India has seen strong growth in tax revenue, especially direct taxes. Mechanisms like Advance Pricing Agreements (APA) and General Anti-Avoidance Rules (GAAR) are tools to ensure fairness, reduce disputes, and prevent tax avoidance or evasion.

India has seen strong growth in tax revenue, especially direct taxes. Mechanisms like Advance Pricing Agreements (APA) and General Anti-Avoidance Rules (GAAR) are tools to ensure fairness, reduce disputes, and prevent tax avoidance or evasion.

Comparison: APA vs GAAR

| Aspect | Advance Pricing Agreement (APA) | General Anti-Avoidance Rules (GAAR) |

|---|---|---|

| Definition | Agreement fixing tax method in advance for cross-border deals | Law to prevent artificial tax avoidance arrangements |

| Objective | Reduce disputes, bring tax certainty | Stop aggressive tax planning & safeguard revenue |

| Scope | International transactions (Transfer Pricing) | Any domestic or international transaction aimed at tax avoidance |

| Example | 271 APAs signed by India (2019) | Vodafone case led to GAAR framework |

Mains Key Points

Prelims Strategy Tips

Trends in Tax Revenue Collection and Anti-Avoidance Framework

India’s tax collections (direct + indirect) have been showing strong growth in recent years. Direct tax revenues have crossed ₹22.26 lakh crore in FY 2024-25, reflecting a buoyant economy and widening tax base. Alongside, legal frameworks like APA (Advance Pricing Agreements) and GAAR (General Anti-Avoidance Rules) ensure fairness in taxation and curb aggressive tax avoidance.

India’s tax collections (direct + indirect) have been showing strong growth in recent years. Direct tax revenues have crossed ₹22.26 lakh crore in FY 2024-25, reflecting a buoyant economy and widening tax base. Alongside, legal frameworks like APA (Advance Pricing Agreements) and GAAR (General Anti-Avoidance Rules) ensure fairness in taxation and curb aggressive tax avoidance.

Key Aspects of Tax Trends and Anti-Avoidance Framework

| Aspect | Details |

|---|---|

| Direct Tax Collection (FY 2024-25) | ₹22.26 lakh crore (13.57% YoY growth) |

| Gross Tax Revenue (FY 2024-25) | ₹38.3 lakh crore |

| Tax-to-GDP Ratio | Expected ~12% by FY 2025-26 |

| Advance Pricing Agreement (APA) | Certainty in transfer pricing; Unilateral, Bilateral, Multilateral types |

| General Anti-Avoidance Rules (GAAR) | Prevents artificial arrangements for tax avoidance, effective since 2017 |

Mains Key Points

Prelims Strategy Tips

Chapter Complete!

Ready to move to the next chapter?