Economics Playlist

18 chapters • 0 completed

Introduction to Economics

10 topics

National Income

17 topics

Inclusive growth

15 topics

Inflation

21 topics

Money

15 topics

Banking

38 topics

Monetary Policy

15 topics

Investment Models

9 topics

Food Processing Industries

9 topics

Taxation

28 topics

Budgeting and Fiscal Policy

24 topics

Financial Market

34 topics

External Sector

37 topics

Industries

21 topics

Land Reforms in India

16 topics

Poverty, Hunger and Inequality

24 topics

Planning in India

16 topics

Unemployment

17 topics

Chapter 18: Unemployment

Chapter TestUnemployment in India

Unemployment refers to the situation where people who are willing and able to work cannot find jobs. In India, unemployment is measured by the National Statistical Office (NSO) using surveys like the Periodic Labour Force Survey (PLFS). It is a critical socio-economic issue as it affects income, development, and overall standard of living.

Unemployment refers to the situation where people who are willing and able to work cannot find jobs. In India, unemployment is measured by the National Statistical Office (NSO) using surveys like the Periodic Labour Force Survey (PLFS). It is a critical socio-economic issue as it affects income, development, and overall standard of living.

Unemployment Data Sources in India

| Source | Frequency | Key Points |

|---|---|---|

| Census of India | Every 10 years | Comprehensive data, but outdated due to long gap |

| NSSO Quinquennial Surveys | Every 5 years (till 2011–12) | Provided employment-unemployment data |

| Periodic Labour Force Survey (PLFS) | Annual + Quarterly (since 2017) | Gives frequent, reliable estimates of unemployment and labour participation |

Mains Key Points

Prelims Strategy Tips

Periodic Labour Force Survey (PLFS) & Measurement of Unemployment in India

PLFS is India’s key survey by the National Statistical Office (NSO) to measure employment and unemployment trends. It provides short-term (quarterly for urban areas) and long-term (annual for rural + urban) data on indicators like Labour Force Participation Rate (LFPR), Worker Population Ratio (WPR), and Unemployment Rate (UR). To measure unemployment, NSO uses three approaches: Daily Status, Weekly Status, and Usual Status.

PLFS is India’s key survey by the National Statistical Office (NSO) to measure employment and unemployment trends. It provides short-term (quarterly for urban areas) and long-term (annual for rural + urban) data on indicators like Labour Force Participation Rate (LFPR), Worker Population Ratio (WPR), and Unemployment Rate (UR). To measure unemployment, NSO uses three approaches: Daily Status, Weekly Status, and Usual Status.

Unemployment Measurement Approaches

| Approach | Time Frame | Features | Estimate Level |

|---|---|---|---|

| Daily Status (CDS) | Each day of last 7 days | Half-day as unit, captures short spells of unemployment | Highest |

| Weekly Status (CWS) | Last 7 days | Employed if worked ≥1 hour on ≥1 day | Medium |

| Usual Status (UPS/PS+SS) | Last 365 days | Long-term unemployment, major part of year without work | Lowest |

Mains Key Points

Prelims Strategy Tips

Latest Trends in Employment and Types of Unemployment in India

Recent PLFS and Economic Survey data show that Worker Population Ratio (WPR) has been increasing, Unemployment Rate (UR) has been decreasing, and Labour Force Participation Rate (LFPR) among rural women has risen significantly post-Covid. India faces multiple types of unemployment such as disguised, structural, seasonal, technological, cyclical, frictional, voluntary, and involuntary unemployment, reflecting both rural and urban challenges.

Recent PLFS and Economic Survey data show that Worker Population Ratio (WPR) has been increasing, Unemployment Rate (UR) has been decreasing, and Labour Force Participation Rate (LFPR) among rural women has risen significantly post-Covid. India faces multiple types of unemployment such as disguised, structural, seasonal, technological, cyclical, frictional, voluntary, and involuntary unemployment, reflecting both rural and urban challenges.

Types of Unemployment in India

| Type | Definition | Example |

|---|---|---|

| Disguised | More workers employed than required, marginal productivity = 0 | Agriculture with surplus labour |

| Structural | Mismatch between skills and jobs | MBA working as cashier |

| Seasonal | Employment only in certain seasons | Agricultural labourers, construction |

| Technological | Jobs lost due to automation/technology | Robots replacing factory workers |

| Cyclical | Job loss due to recession | Layoffs during economic slowdown |

| Frictional | Temporary unemployment during job change | Switching jobs |

| Voluntary | Not working by choice | Rejecting jobs due to wage demands |

| Involuntary | Willing to work but no jobs available | Recession-hit workers |

Mains Key Points

Prelims Strategy Tips

Sectoral Distribution of Employment and Causes of Unemployment in India

PLFS and QES data show that employment in agriculture is declining, while industry and services sectors are expanding as major job providers. Despite this, India faces persistent unemployment challenges due to population growth, stagnant agriculture, decline of small industries, low investment in manufacturing, and lack of skills.

PLFS and QES data show that employment in agriculture is declining, while industry and services sectors are expanding as major job providers. Despite this, India faces persistent unemployment challenges due to population growth, stagnant agriculture, decline of small industries, low investment in manufacturing, and lack of skills.

Sectoral Employment Distribution (2018-20)

| Sector | Jobs Created / Trend |

|---|---|

| Agriculture | Declining share and number of workers |

| Industry | +4.8 million (2018-19), +3.4 million (2019-20) |

| Services | +10.1 million (2018-19), +6 million (2019-20) |

| QES (9 sectors) | 3.2 crore jobs (Jan–Mar 2022), 83% of organized jobs |

| ASI (Manufacturing) | Largest employers: Food (11.1%), Apparel (7.6%), Metals (7.3%), Motor vehicles (6.5%) |

Mains Key Points

Prelims Strategy Tips

Formal and Informal Sector in India

The Indian economy is divided into the formal (organised) sector and informal (unorganised) sector. The formal sector includes government-regulated enterprises with job security, social benefits, and legal recognition. The informal sector includes unregulated activities such as street vending and small unregistered businesses, employing the majority of India’s workforce but without job security or social protection.

The Indian economy is divided into the formal (organised) sector and informal (unorganised) sector. The formal sector includes government-regulated enterprises with job security, social benefits, and legal recognition. The informal sector includes unregulated activities such as street vending and small unregistered businesses, employing the majority of India’s workforce but without job security or social protection.

Difference between Formal and Informal Sector

| Basis | Formal Sector | Informal Sector |

|---|---|---|

| Meaning | Government-regulated businesses and economic activities | Unregulated businesses outside government control |

| Social Security | Employees entitled to benefits like PF, pension, ESI | No entitlement to social security benefits |

| Salary/Wage | Higher and fixed pay scale | Low and uncertain pay scale |

| Job Security | Stable jobs with fixed working hours | No job security, irregular hours |

| Taxation | Enterprises licensed and pay taxes | Generally do not pay taxes |

| Employees | Firms with 10+ employees | Mostly self-employed or firms with <10 workers |

| Trade Unions | Right to form unions to protect interests | No legal right to form unions |

Mains Key Points

Prelims Strategy Tips

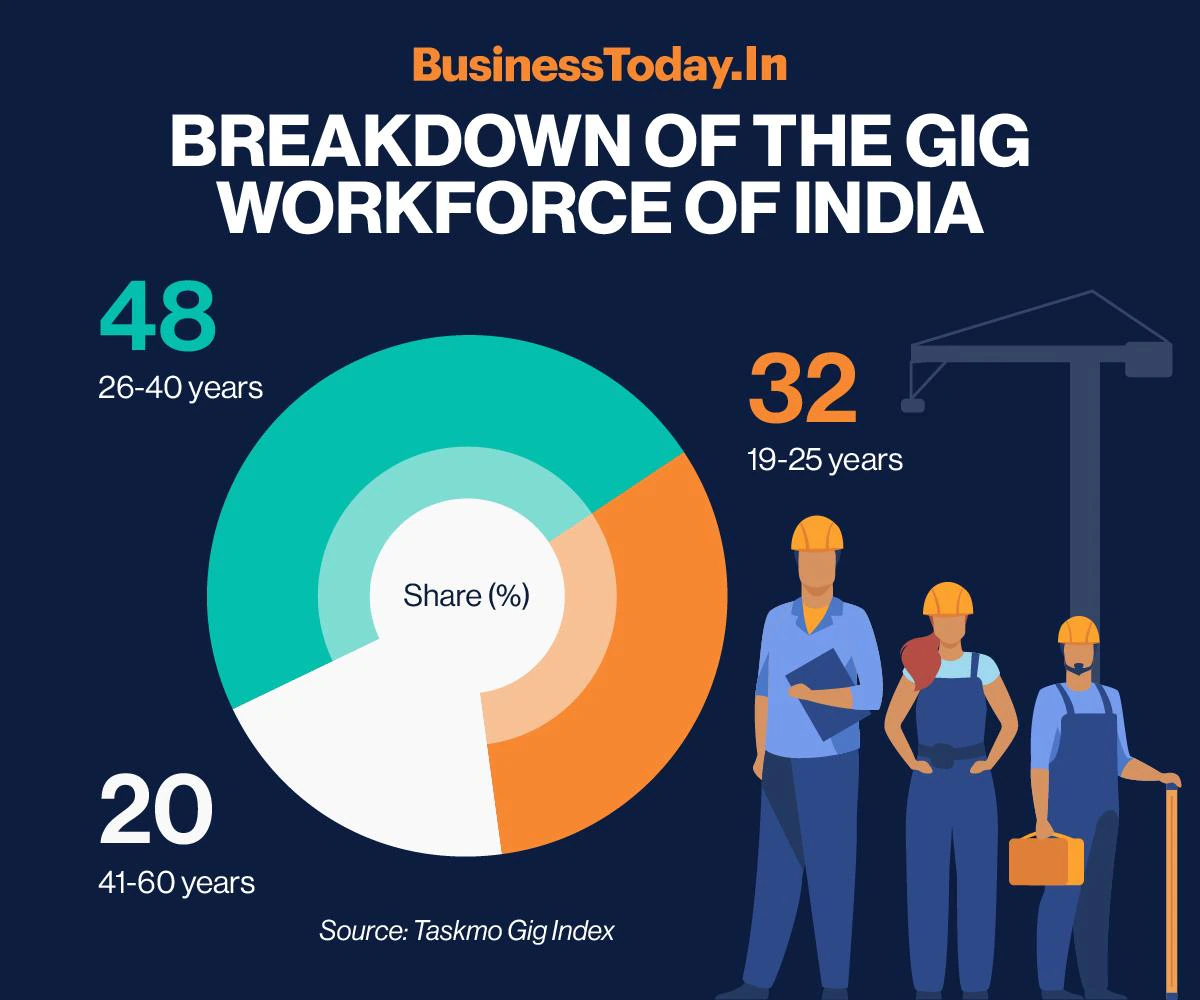

Gig Workers in India

Gig workers are individuals engaged in short-term, flexible jobs, often through digital platforms like Ola, Uber, Swiggy, and Zomato. They are not regular employees but independent workers who provide services on demand. India is one of the largest hubs of gig work, and this sector is expected to expand significantly in the coming decade.

Gig workers are individuals engaged in short-term, flexible jobs, often through digital platforms like Ola, Uber, Swiggy, and Zomato. They are not regular employees but independent workers who provide services on demand. India is one of the largest hubs of gig work, and this sector is expected to expand significantly in the coming decade.

Growth of Gig Workforce in India

| Year | Gig Workers (in millions) | Share in Workforce |

|---|---|---|

| 2019-20 | 6.8 million (68 lakh) | 2.4% of non-farm workforce |

| 2020-21 | 7.7 million (77 lakh) | 2.6% of non-farm workforce |

| 2029-30 (Projected) | 23.5 million (2.35 crore) | 6.7% of non-farm workforce |

Mains Key Points

Prelims Strategy Tips

Informalisation of Indian Workforce

Informalisation refers to the rising trend of workers and economic activities outside the formal sector, where workers lack legal protection, contracts, or social security. In India, more than 90% of the total workforce is engaged in the informal sector, which contributes nearly half of the country’s GDP.

Informalisation refers to the rising trend of workers and economic activities outside the formal sector, where workers lack legal protection, contracts, or social security. In India, more than 90% of the total workforce is engaged in the informal sector, which contributes nearly half of the country’s GDP.

E-Shram Portal – Informal Worker Data

| Category | Details |

|---|---|

| Occupation | Agriculture (52.11%), Domestic Workers (9.93%), Construction (9.13%) |

| Social Category | 74% SC/ST/OBC, 25.56% General |

| Income | 94.11% earn ≤ ₹10,000; 4.36% earn ₹10,001–₹15,000 |

| Age | 18–40 years (61.72%), 40–50 years (22.12%), >50 years (13.23%), 16–18 years (2.93%) |

| Gender | Female (52.81%), Male (47.19%) |

| Top States | UP, Bihar, West Bengal, MP, Odisha |

Mains Key Points

Prelims Strategy Tips

Government Initiatives for Informal/Unorganised Sector & Impact of Unemployment

The Government of India has introduced multiple schemes to provide social security, health, pensions, and employment opportunities for workers in the informal/unorganised sector, who form more than 90% of the workforce. However, unemployment continues to pose challenges such as poverty, social unrest, and loss of human capital.

The Government of India has introduced multiple schemes to provide social security, health, pensions, and employment opportunities for workers in the informal/unorganised sector, who form more than 90% of the workforce. However, unemployment continues to pose challenges such as poverty, social unrest, and loss of human capital.

Key Schemes for Informal Sector Workers

| Scheme | Objective/Benefit |

|---|---|

| National Pension Scheme (Traders & Self-employed) | Old-age protection for traders, shopkeepers, and self-employed. |

| PMJJBY | Life insurance for death due to any reason. |

| PM-SYM | Pension for unorganised workers like vendors, labourers, fishermen. |

| Ayushman Bharat (PM-JAY) | ₹5 lakh health insurance per family per year. |

| Atal Pension Yojana | Universal pension system for poor and unorganised workers. |

| Garib Kalyan Rozgar Yojana | Employment support for migrant workers post-COVID. |

Mains Key Points

Prelims Strategy Tips

Government Initiative to Control Unemployment – MGNREGA

The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), 2005, provides a legal right to work for rural households by guaranteeing 100 days of wage employment in a year. It is a demand-driven programme aimed at reducing rural poverty, creating durable assets, and ensuring social security.

The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), 2005, provides a legal right to work for rural households by guaranteeing 100 days of wage employment in a year. It is a demand-driven programme aimed at reducing rural poverty, creating durable assets, and ensuring social security.

MGNREGA – Key Features and Achievements

| Aspect | Details |

|---|---|

| Launch Year | 2005 |

| Legal Guarantee | 100 days of paid employment per rural household per year |

| Budget Allocation 2021-22 | ₹73,000 crore |

| Person-days Generated | 3089.49 crore (till Aug 2020) |

| Women Participation | More than 50% (against minimum 33%) |

| Assets Created | 3.6 crore geo-tagged assets by 2019 |

Mains Key Points

Prelims Strategy Tips

Government Initiatives to Control Unemployment – PMKVY & Others

Pradhan Mantri Kaushal Vikas Yojana (PMKVY), launched in 2015, is India’s flagship skill development scheme that provides industry-relevant skill training to youth for better livelihood opportunities. Alongside, several other initiatives like Start-up India, Stand-up India, PMMY, GKRA, PM GatiShakti, and PLI Scheme aim to boost self-employment, entrepreneurship, and job creation.

Pradhan Mantri Kaushal Vikas Yojana (PMKVY), launched in 2015, is India’s flagship skill development scheme that provides industry-relevant skill training to youth for better livelihood opportunities. Alongside, several other initiatives like Start-up India, Stand-up India, PMMY, GKRA, PM GatiShakti, and PLI Scheme aim to boost self-employment, entrepreneurship, and job creation.

Key Employment-Related Initiatives

| Scheme | Year | Objective |

|---|---|---|

| PMKVY | 2015 | Industry-relevant skills training for youth |

| Start-Up India | 2016 | Promote entrepreneurship ecosystem |

| Stand-Up India | 2016 | Bank loans for SC/ST and women entrepreneurs |

| PMMY | 2015 | Collateral-free loans up to ₹10 lakh |

| GKRA | 2020 | Employment for migrant workers in 116 districts |

| PM GatiShakti | 2021 | Infrastructure-driven job creation |

| PLI Scheme | 2020 | Boost manufacturing and generate employment |

| NRLM (Aajeevika) | 2011 | Sustainable rural livelihoods |

Mains Key Points

Prelims Strategy Tips

Labour Reforms in India

Labour reforms in India aim to simplify and modernize existing labour laws, protect workers' rights, and ensure industrial growth. With over 40 central laws and 100 state-level laws, labour reforms seek to bring transparency, reduce compliance burden, and balance the interests of both workers and employers.

Labour reforms in India aim to simplify and modernize existing labour laws, protect workers' rights, and ensure industrial growth. With over 40 central laws and 100 state-level laws, labour reforms seek to bring transparency, reduce compliance burden, and balance the interests of both workers and employers.

Key Challenges in India’s Labour Laws

| Challenge | Explanation |

|---|---|

| Multiplicity of Laws | Over 140 central and state laws create complexity. |

| Ease of Doing Business | Industries face multiple inspections and compliance hurdles. |

| Enforcement Issues | Weak monitoring and corruption reduce effectiveness. |

| Global Competitiveness | Rigid laws make India less competitive globally. |

| Outdated Provisions | Many laws are colonial-era and need modernization. |

Mains Key Points

Prelims Strategy Tips

Labour Codes Introduced by Government

The Government of India replaced 29 existing labour laws with 4 simplified Labour Codes – Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020), and Occupational Safety, Health and Working Conditions Code (2020). The aim is to simplify, modernize, and bring uniformity in labour regulation while balancing workers’ welfare with economic growth.

The Government of India replaced 29 existing labour laws with 4 simplified Labour Codes – Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020), and Occupational Safety, Health and Working Conditions Code (2020). The aim is to simplify, modernize, and bring uniformity in labour regulation while balancing workers’ welfare with economic growth.

Labour Codes and Subsumed Laws

| Labour Code | Acts Subsumed |

|---|---|

| Code on Wages (2019) | Payment of Wages Act, Minimum Wages Act, Payment of Bonus Act, Equal Remuneration Act |

| Industrial Relations Code (2020) | Trade Unions Act, Industrial Employment Act, Industrial Disputes Act |

| Code on Social Security (2020) | EPF Act, ESI Act, Employees’ Compensation Act, Maternity Benefit Act, Gratuity Act, etc. |

| OSH & Working Conditions Code (2020) | Factories Act, Mines Act, Contract Labour Act, Building & Other Construction Workers Act, etc. |

Mains Key Points

Prelims Strategy Tips

Code on Social Security, 2020 & Code on Occupational Safety, Health and Working Conditions, 2020

The Social Security Code, 2020 consolidates 9 labour laws to provide comprehensive social security like insurance, pension, gratuity, maternity benefits, etc., especially extending coverage to unorganised, gig, and platform workers. The Occupational Safety, Health and Working Conditions Code, 2020 consolidates 13 laws to ensure safe, healthy, and fair working conditions, covering factories, mines, plantations, and contract workers.

The Social Security Code, 2020 consolidates 9 labour laws to provide comprehensive social security like insurance, pension, gratuity, maternity benefits, etc., especially extending coverage to unorganised, gig, and platform workers. The Occupational Safety, Health and Working Conditions Code, 2020 consolidates 13 laws to ensure safe, healthy, and fair working conditions, covering factories, mines, plantations, and contract workers.

Comparison of Social Security Code and OSHWC Code

| Aspect | Social Security Code (2020) | OSHWC Code (2020) |

|---|---|---|

| Objective | Provide insurance, pension, gratuity, maternity benefit | Ensure safe and healthy working conditions |

| Workers Covered | Unorganised, gig, platform, formal workers | Factory, mine, plantation, contract, women, migrants |

| Special Provisions | Social security funds, reduced gratuity terms | 8-hour limit, women night shifts, migrant benefits |

| Institutions | National Social Security Board | National Safety & Health Advisory Board |

Mains Key Points

Prelims Strategy Tips

Code on Industrial Relations, 2020

The Industrial Relations Code, 2020 consolidates 3 labour laws into one framework to regulate trade unions, industrial disputes, closure, retrenchment, and employment contracts. It aims to balance worker rights with employer flexibility, reduce disputes, and promote industrial harmony.

The Industrial Relations Code, 2020 consolidates 3 labour laws into one framework to regulate trade unions, industrial disputes, closure, retrenchment, and employment contracts. It aims to balance worker rights with employer flexibility, reduce disputes, and promote industrial harmony.

Comparison of Employment Types under Industrial Relations Code, 2020

| Feature | Fixed Term Employee | Permanent Employee | Contract Labour |

|---|---|---|---|

| Type of Employment | Direct contract, no contractor | On payroll of establishment | Through contractor/agency |

| Term | Ends after fixed term; no retrenchment notice | Ongoing; notice needed for termination | Based on contractor’s terms |

| Nature of Work | Routine or specialized tasks | Routine, ongoing work | Often prohibited in core activities |

Mains Key Points

Prelims Strategy Tips

Impacts of Labour Codes

The new labour codes simplify and unify labour laws but bring significant implications for employers and employees. Key impacts are related to the definition of worker, uniform definition of wages, gratuity, leave encashment, and provident fund contributions.

The new labour codes simplify and unify labour laws but bring significant implications for employers and employees. Key impacts are related to the definition of worker, uniform definition of wages, gratuity, leave encashment, and provident fund contributions.

Key Impacts of Labour Codes

| Aspect | Impact |

|---|---|

| Definition of Worker | Clearer classification but challenges in implementation. |

| Definition of Wages | Uniform definition; at least 50% of gross salary considered wages. |

| Gratuity | Payable on broader wage definition; increases cost for employers. |

| Leave Encashment | Now mandatory for workers based on wages, not just basic pay. |

| Provident Fund | Contributions on wages; higher deductions for employees and costs for employers. |

Mains Key Points

Prelims Strategy Tips

Enabling Employment Opportunities under Labour Codes

The new labour codes aim to expand employment opportunities, especially for women, and make laws more inclusive by covering modern forms of employment. They also ensure faster settlement of employee dues and encourage gender equality at workplaces.

The new labour codes aim to expand employment opportunities, especially for women, and make laws more inclusive by covering modern forms of employment. They also ensure faster settlement of employee dues and encourage gender equality at workplaces.

Key Provisions Encouraging Employment

| Aspect | Provisions under Labour Codes |

|---|---|

| Women’s Employment | Night shifts allowed with safety, flexible work options provided |

| Coverage | Applies to all employees including gig and platform workers |

| F&F Settlements | Wages must be cleared within 2 working days of exit |

Mains Key Points

Prelims Strategy Tips

Issues and Concerns with New Labour Codes

While the new consolidated labour codes aim to simplify and modernize labour laws, several issues and concerns have been raised regarding jurisdiction, exemptions, workers' rights, Aadhaar linkage, and clarity of definitions.

While the new consolidated labour codes aim to simplify and modernize labour laws, several issues and concerns have been raised regarding jurisdiction, exemptions, workers' rights, Aadhaar linkage, and clarity of definitions.

Issues in New Labour Codes

| Issue | Concern |

|---|---|

| Jurisdiction | Centre retains control over PSUs even without majority stake |

| Exemptions | Broad power to exempt establishments under 'public interest' |

| Strikes/Lockouts | Heavily restricted, reducing worker bargaining power |

| Aadhaar Linking | May violate Supreme Court judgement on privacy |

| Hire & Fire | Gives employers more liberty, risk of arbitrary conditions |

| Work Hours | Rigid 8-hour limit, lacks flexibility |

| Definitions | Overlap between gig, platform, and unorganised workers |

Mains Key Points

Prelims Strategy Tips

Chapter Complete!

Congratulations! You've completed all chapters.