Economics Playlist

18 chapters • 0 completed

Introduction to Economics

10 topics

National Income

17 topics

Inclusive growth

15 topics

Inflation

21 topics

Money

15 topics

Banking

38 topics

Monetary Policy

15 topics

Investment Models

9 topics

Food Processing Industries

9 topics

Taxation

28 topics

Budgeting and Fiscal Policy

24 topics

Financial Market

34 topics

External Sector

37 topics

Industries

21 topics

Land Reforms in India

16 topics

Poverty, Hunger and Inequality

24 topics

Planning in India

16 topics

Unemployment

17 topics

Chapter 12: Financial Market

Chapter TestFinancial Market

A financial market is a platform where people with extra money (savers/investors) provide funds to those who need money (borrowers/businesses). It enables creation, trading, and exchange of financial assets like shares, bonds, and debentures. It acts as a bridge between savers and users of funds.

A financial market is a platform where people with extra money (savers/investors) provide funds to those who need money (borrowers/businesses). It enables creation, trading, and exchange of financial assets like shares, bonds, and debentures. It acts as a bridge between savers and users of funds.

Difference Between Money Market and Capital Market

| Aspect | Money Market | Capital Market |

|---|---|---|

| Nature of Funds | Short-term (up to 364 days) | Medium & long-term (more than 1 year) |

| Examples | T-Bills, Commercial Papers, Certificate of Deposit | Equity Shares, Preference Shares, Bonds, Debentures |

| Purpose | Short-term needs like working capital, cash flow | Long-term needs like business expansion, infrastructure |

| Risk | Lower risk due to short duration | Higher risk due to longer maturity |

| Major Regulator | RBI | SEBI |

| Main Players | RBI, Commercial Banks, Financial Institutions, Mutual Funds | Stock Exchanges, Investors, Brokers, Underwriters |

Mains Key Points

Prelims Strategy Tips

Money Market

The money market is the part of the financial market where short-term funds (up to one year) are borrowed and lent. It provides liquidity, helps in interest rate determination, and acts as an avenue for the government, banks, and companies to manage short-term financial needs.

The money market is the part of the financial market where short-term funds (up to one year) are borrowed and lent. It provides liquidity, helps in interest rate determination, and acts as an avenue for the government, banks, and companies to manage short-term financial needs.

Key Instruments of Indian Money Market

| Instrument | Description | Example |

|---|---|---|

| Treasury Bills (T-Bills) | Short-term government securities, risk-free | Issued by RBI for 91, 182, 364 days |

| Commercial Papers (CPs) | Unsecured short-term debt by companies | Issued by corporates to raise funds |

| Certificates of Deposit (CDs) | Short-term instruments issued by banks | Banks raise funds from investors |

| Repo Transactions | Short-term borrowing with securities as collateral | Banks borrow using government securities |

| Call Money Market | Overnight borrowing and lending among banks | Banks manage daily liquidity needs |

Mains Key Points

Prelims Strategy Tips

Money Market Instruments – Call Money

Call Money is a short-term money market instrument where banks and financial institutions borrow and lend funds for just one day (overnight). It helps banks meet temporary liquidity needs without requiring any collateral. The interest rate in this market is called the 'Call Rate'.

Call Money is a short-term money market instrument where banks and financial institutions borrow and lend funds for just one day (overnight). It helps banks meet temporary liquidity needs without requiring any collateral. The interest rate in this market is called the 'Call Rate'.

Key Aspects of Call Money

| Aspect | Details |

|---|---|

| Nature | Short-term borrowing and lending for 1 day (overnight) |

| Interest Rate | Call Rate (highly volatile, demand-supply driven) |

| Collateral | No security or collateral required |

| Participants | Banks, Financial Institutions, select NBFCs |

| Regulator | Reserve Bank of India (RBI) |

| Use | To meet short-term liquidity requirements |

Mains Key Points

Prelims Strategy Tips

Money Market Instruments – Notice Money & Treasury Bills

Notice Money and Treasury Bills (T-bills) are two important instruments of the Indian money market. Notice Money allows borrowing and lending between banks and institutions for 2–14 days, while Treasury Bills are short-term government securities issued at a discount and redeemed at face value.

Notice Money and Treasury Bills (T-bills) are two important instruments of the Indian money market. Notice Money allows borrowing and lending between banks and institutions for 2–14 days, while Treasury Bills are short-term government securities issued at a discount and redeemed at face value.

Comparison: Notice Money vs Treasury Bills

| Aspect | Notice Money | Treasury Bills |

|---|---|---|

| Nature | Short-term borrowing/lending for 2–14 days | Short-term debt instrument issued by Govt. |

| Issuer | Banks and financial institutions | Government of India (via RBI) |

| Tenure | 2–14 days | 91, 182, 364 days |

| Interest | Market-determined interest rate | No interest; issued at discount, redeemed at face value |

| Participants | Banks, FIs, eligible NBFCs, RRBs (since 2020) | Investors, banks, financial institutions, individuals |

| Risk | Relatively high (market-driven, unsecured) | Lowest risk (sovereign guarantee) |

Mains Key Points

Prelims Strategy Tips

Money Market Instruments – Treasury Bills, Cash Management Bills, Certificates of Deposit, and Commercial Papers

Indian Money Market offers various short-term instruments like Treasury Bills, Cash Management Bills, Certificates of Deposit, and Commercial Papers. They differ in issuers, maturity, risk, and purpose but all help manage short-term liquidity and provide investment avenues.

Indian Money Market offers various short-term instruments like Treasury Bills, Cash Management Bills, Certificates of Deposit, and Commercial Papers. They differ in issuers, maturity, risk, and purpose but all help manage short-term liquidity and provide investment avenues.

Comparison of Money Market Instruments

| Instrument | Issuer | Tenure | Nature | Risk Level |

|---|---|---|---|---|

| Treasury Bills | Government of India (via RBI) | 91, 182, 364 days | Discounted, no interest | Lowest (sovereign backed) |

| Cash Management Bills | Government of India (via RBI) | Up to 90 days | Discounted, auction-based | Very Low |

| Certificate of Deposit | Banks & FIs | 7 days – 1 year (Banks); 1–3 years (FIs) | Discounted, transferable | Low |

| Commercial Paper | Companies, FIs, PDs | 7 days – 1 year | Discounted, unsecured | Moderate (depends on rating) |

Mains Key Points

Prelims Strategy Tips

Money Market Instrument – Trade Bills

Trade Bills (also called Bills of Exchange or Trade Acceptance Bills) are short-term negotiable instruments used in trade financing. They allow sellers to get immediate funds by discounting bills with banks, while buyers get credit time to make payments. When accepted by banks, they are called Commercial Bills.

Trade Bills (also called Bills of Exchange or Trade Acceptance Bills) are short-term negotiable instruments used in trade financing. They allow sellers to get immediate funds by discounting bills with banks, while buyers get credit time to make payments. When accepted by banks, they are called Commercial Bills.

Key Aspects of Trade Bills

| Aspect | Details |

|---|---|

| Issuer | Seller of goods/services |

| Acceptor | Buyer of goods/services |

| Maturity | 30, 60, or 90 days |

| Discounting | Bills can be discounted with banks/FIs for early cash |

| When accepted by banks | Called Commercial Bills |

Mains Key Points

Prelims Strategy Tips

Money Market Instrument – Repo, Reverse Repo & Triparty Repo

Repo (Repurchase Agreement) and Reverse Repo are short-term money market instruments where securities are sold and repurchased or bought and resold at a future date with interest. Triparty Repo adds a third-party agent to manage settlement, collateral, and custody. These tools are crucial for liquidity management and monetary policy transmission.

Repo (Repurchase Agreement) and Reverse Repo are short-term money market instruments where securities are sold and repurchased or bought and resold at a future date with interest. Triparty Repo adds a third-party agent to manage settlement, collateral, and custody. These tools are crucial for liquidity management and monetary policy transmission.

Comparison of Repo, Reverse Repo & Triparty Repo

| Aspect | Repo | Reverse Repo | Triparty Repo |

|---|---|---|---|

| Nature | Borrowing funds by selling securities with repurchase agreement | Lending funds by buying securities with resale agreement | Borrowing/lending with third-party agent managing settlement & collateral |

| Parties | Borrower (seller of securities), Lender (buyer) | Lender (buyer of securities), Borrower (seller) | Borrower, Lender, Tri-Party Agent (e.g., CCIL) |

| Repo Period | 1 day – 1 year (mainly overnight) | 1 day – 1 year (mainly overnight) | T+0 or T+1 settlement options |

| Collateral | G-secs, corporate bonds, CPs, CDs | G-secs, corporate bonds, CPs, CDs | Same as repo, managed by Tri-Party Agent |

| Regulator/Platform | RBI, CROMS | RBI, CROMS | RBI, TREPS via CCIL |

| Risk | Moderate (secured) | Low (secured, lender position) | Low (secured + third-party guarantee) |

Mains Key Points

Prelims Strategy Tips

Interest Rate Benchmarks – LIBOR and MIBOR

Interest rate benchmarks like LIBOR (London Interbank Offered Rate) and MIBOR (Mumbai Interbank Offered Rate) are reference rates used in financial markets to price, value, and settle loans, derivatives, and other instruments. They ensure transparency, consistency, and comparability across financial products. While LIBOR was a global benchmark, it has been phased out due to reliability issues. MIBOR continues to serve as the Indian benchmark for interbank borrowing.

Interest rate benchmarks like LIBOR (London Interbank Offered Rate) and MIBOR (Mumbai Interbank Offered Rate) are reference rates used in financial markets to price, value, and settle loans, derivatives, and other instruments. They ensure transparency, consistency, and comparability across financial products. While LIBOR was a global benchmark, it has been phased out due to reliability issues. MIBOR continues to serve as the Indian benchmark for interbank borrowing.

Comparison: LIBOR vs MIBOR

| Aspect | LIBOR | MIBOR |

|---|---|---|

| Meaning | London Interbank Offered Rate – Global benchmark | Mumbai Interbank Offered Rate – Indian benchmark |

| Introduced | 1969 (formalised later, administered by ICE) | 1998 (launched by NSE) |

| Currencies | USD, GBP, EUR, JPY, CHF | Indian Rupee (INR) |

| Tenure | Overnight to 12 months | Mostly overnight (short-term) |

| Use | Loans, derivatives, global financial contracts | Indian money market, loans, debentures, swaps |

| Current Status | Phased out since 2021; replaced by SOFR, SONIA, SARON, TONAR | Still in use in India |

Mains Key Points

Prelims Strategy Tips

Unorganised Money Market in India

The Unorganised Money Market in India has existed since ancient times and continues to operate today. Unlike the organised money market, it is not directly regulated by the Reserve Bank of India but is recognized by the government. It consists of chit funds, Nidhi companies, loan companies, indigenous bankers, and local moneylenders. These provide savings and credit facilities to people with limited access to formal banking.

The Unorganised Money Market in India has existed since ancient times and continues to operate today. Unlike the organised money market, it is not directly regulated by the Reserve Bank of India but is recognized by the government. It consists of chit funds, Nidhi companies, loan companies, indigenous bankers, and local moneylenders. These provide savings and credit facilities to people with limited access to formal banking.

Categories of Unorganised Money Market

| Category | Description |

|---|---|

| Chit Funds | Community-based saving scheme; regulated by Chit Funds Act, 1982. |

| Nidhi Companies | Member-based companies promoting thrift and savings; registered under Companies Act, 2013. |

| Loan Companies | Provide loans outside the banking system with limited regulation. |

| Indigenous Bankers | Private individuals/firms accepting deposits and lending like banks. |

| Moneylenders | Local lenders giving high-interest loans; often exploitative. |

Mains Key Points

Prelims Strategy Tips

Capital Market – Primary and Secondary Markets

The Capital Market is the long-term financial market of an economy where equity and debt securities are traded. It serves as a bridge between investors with surplus funds and businesses or governments needing funds for long-term projects. The capital market consists of two main segments: the Primary Market (new issue of securities) and the Secondary Market (resale of securities).

The Capital Market is the long-term financial market of an economy where equity and debt securities are traded. It serves as a bridge between investors with surplus funds and businesses or governments needing funds for long-term projects. The capital market consists of two main segments: the Primary Market (new issue of securities) and the Secondary Market (resale of securities).

Key Features of Capital Market

| Aspect | Details |

|---|---|

| Nature | Long-term financial market (equity & debt) |

| Participants | Investors (households, FIs, mutual funds, insurance) and borrowers (corporates, govt) |

| Instruments | Equity shares, preference shares, bonds, debentures |

| Segments | Primary Market (new issues) and Secondary Market (resale of securities) |

| Objective | Mobilisation of long-term funds for economic growth |

Mains Key Points

Prelims Strategy Tips

Methods of Issuing Shares in Capital Market

Companies raise capital by issuing shares through various methods in the primary market. Common methods include Initial Public Offer (IPO), Follow-on Public Offer (FPO), Preferential Issues, and Rights Issues. Each method has different rules, objectives, and target investors, but all aim to mobilize funds for business expansion, diversification, or debt repayment.

Companies raise capital by issuing shares through various methods in the primary market. Common methods include Initial Public Offer (IPO), Follow-on Public Offer (FPO), Preferential Issues, and Rights Issues. Each method has different rules, objectives, and target investors, but all aim to mobilize funds for business expansion, diversification, or debt repayment.

Methods of Issuing Shares – Comparison

| Method | Target Investors | Key Features | Examples |

|---|---|---|---|

| IPO | General Public | First issue of shares by a private company going public | Zomato, SBI Cards, IRFC |

| FPO | Existing & New Investors | Additional shares issued after IPO | Many listed companies use FPOs |

| Preferential Issues | Select Group of Investors | Shares issued to promoters/institutional investors, not public | Tata Steel (2020), Reliance Comm (2018) |

| Rights Issue | Existing Shareholders | Shares offered at discount in proportion to existing holdings | Used by listed companies to raise funds |

Mains Key Points

Prelims Strategy Tips

Secondary Market and Shares in Capital Market

The Secondary Market, also known as the stock market or stock exchange, is where existing securities are bought and sold. It provides liquidity to investors, allowing them to disinvest and reinvest, and helps channel funds into productive sectors. The main instruments traded in the secondary market are shares (equity and preference shares).

The Secondary Market, also known as the stock market or stock exchange, is where existing securities are bought and sold. It provides liquidity to investors, allowing them to disinvest and reinvest, and helps channel funds into productive sectors. The main instruments traded in the secondary market are shares (equity and preference shares).

Equity vs Preference Shares

| Aspect | Equity Shares | Preference Shares |

|---|---|---|

| Ownership Rights | Full ownership with voting rights | Ownership without voting rights |

| Dividends | Variable, depends on profits | Fixed, paid before equity shareholders |

| Risk | High, as linked to profits and share price | Lower, due to fixed returns |

| Liquidity | Traded actively in stock market | Rarely traded due to fixed nature |

| Liquidation Priority | Last to receive payout | Priority over equity but after creditors |

Mains Key Points

Prelims Strategy Tips

Derivatives – Meaning and Types

Derivatives are financial instruments whose value is derived from an underlying asset such as commodities, stocks, currencies, or interest rates. They are contracts between two parties and can be traded on exchanges or over-the-counter (OTC). Derivatives help in hedging risks, speculation, and price discovery. Common types are Futures, Options, Forwards, and Swaps.

Derivatives are financial instruments whose value is derived from an underlying asset such as commodities, stocks, currencies, or interest rates. They are contracts between two parties and can be traded on exchanges or over-the-counter (OTC). Derivatives help in hedging risks, speculation, and price discovery. Common types are Futures, Options, Forwards, and Swaps.

Futures vs Options

| Aspect | Futures | Options |

|---|---|---|

| Nature | Obligation to buy/sell at future date & price | Right (not obligation) to buy/sell at future date & price |

| Traded on | Exchanges (standard contracts) | Exchanges & OTC (flexible contracts) |

| Risk | Higher risk, both parties obligated | Lower risk for buyer (limited to premium paid) |

| Premium | No premium; both bound by contract | Buyer pays premium to seller |

| Use | Hedging, speculation, price lock | Hedging, speculation, flexible exposure |

Mains Key Points

Prelims Strategy Tips

Derivatives – Forwards and Swaps

Forwards and Swaps are over-the-counter (OTC) derivatives, customized contracts between two parties. Forwards are agreements to buy/sell an asset at a fixed price in the future, while Swaps involve exchanging cash flows or liabilities, often based on interest rates or currencies. Both help businesses hedge against risks but carry counterparty risk.

Forwards and Swaps are over-the-counter (OTC) derivatives, customized contracts between two parties. Forwards are agreements to buy/sell an asset at a fixed price in the future, while Swaps involve exchanging cash flows or liabilities, often based on interest rates or currencies. Both help businesses hedge against risks but carry counterparty risk.

Forwards vs Swaps

| Aspect | Forwards | Swaps |

|---|---|---|

| Definition | Agreement to buy/sell asset in future at fixed price | Exchange of cash flows/liabilities based on interest rates, currencies, or commodities |

| Nature | OTC, binding contract | OTC, customized contract |

| Obligation | Both parties must perform | Both parties exchange flows as per agreement |

| Common Use | Hedging price risk in commodities/currencies | Managing interest rate or currency risk |

| Example | Raw material purchase agreement | India-UK currency swap deal |

Mains Key Points

Prelims Strategy Tips

Bonds – Meaning, Features and Types

A Bond is a long-term debt instrument where an investor lends money to a government, company, or other entity. In return, the issuer pays fixed or variable interest (coupon) at regular intervals and repays the principal (face value) at maturity. Bonds are generally less risky than shares, but also offer limited returns.

A Bond is a long-term debt instrument where an investor lends money to a government, company, or other entity. In return, the issuer pays fixed or variable interest (coupon) at regular intervals and repays the principal (face value) at maturity. Bonds are generally less risky than shares, but also offer limited returns.

Key Features of Bonds

| Aspect | Details |

|---|---|

| Issuer | Corporates, Municipalities, State or Central Government |

| Face Value | Value repaid at maturity (e.g., ₹1,000) |

| Coupon Rate | Fixed or variable annual interest (e.g., 5%) |

| Tenure | Time until maturity (e.g., 5 years) |

| Risk | Lower than shares, but limited returns |

Mains Key Points

Prelims Strategy Tips

Types of Bonds – Zero-Coupon, Municipal, Sovereign & Sovereign Gold Bonds

Bonds are long-term debt instruments issued by governments, corporations, or municipal bodies. While most bonds pay periodic interest, some special types exist such as Zero-Coupon Bonds (no interest, issued at discount), Municipal Bonds (issued by city corporations), Sovereign Bonds (issued by governments), and Sovereign Gold Bonds (denominated in grams of gold).

Bonds are long-term debt instruments issued by governments, corporations, or municipal bodies. While most bonds pay periodic interest, some special types exist such as Zero-Coupon Bonds (no interest, issued at discount), Municipal Bonds (issued by city corporations), Sovereign Bonds (issued by governments), and Sovereign Gold Bonds (denominated in grams of gold).

Types of Bonds and Their Features

| Bond Type | Key Features |

|---|---|

| Zero-Coupon Bond | No periodic interest, issued at discount, redeemed at face value |

| Municipal Bond | Issued by city corporations to finance public projects |

| Sovereign Bond | Issued by governments, very safe, fixed interest payments |

| Sovereign Gold Bond | Denominated in grams of gold, tenure 8 years, interest + gold price benefits |

Mains Key Points

Prelims Strategy Tips

Special Types of Bonds – Green, Blue, Social Impact & Inflation-Indexed Bonds

Apart from regular bonds, several innovative bond instruments exist to support specific sectors and causes. Green Bonds fund environment-friendly projects, Blue Bonds finance marine and ocean-based projects, Social Impact Bonds link returns to social outcomes, and Inflation-Indexed Bonds protect investors against inflation. These instruments are vital for sustainable and inclusive growth.

Apart from regular bonds, several innovative bond instruments exist to support specific sectors and causes. Green Bonds fund environment-friendly projects, Blue Bonds finance marine and ocean-based projects, Social Impact Bonds link returns to social outcomes, and Inflation-Indexed Bonds protect investors against inflation. These instruments are vital for sustainable and inclusive growth.

Special Bonds and Their Features

| Bond Type | Purpose / Features |

|---|---|

| Green Bond | Funds renewable energy, clean transport, and eco-projects |

| Blue Bond | Funds marine & ocean projects; supports blue economy |

| Social Impact Bond | Returns linked to achieving social outcomes (education, livelihood, etc.) |

| Inflation-Indexed Bond | Protects principal & interest from inflation; linked to CPI |

Mains Key Points

Prelims Strategy Tips

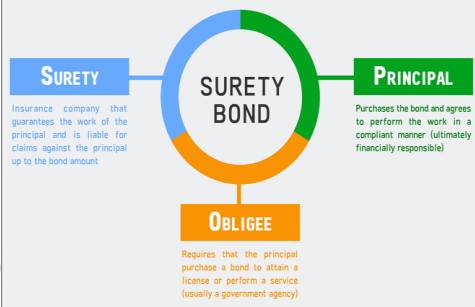

Masala Bonds and Surety Bonds

Masala Bonds are rupee-denominated bonds issued overseas to attract foreign investors, with currency risk borne by investors. Surety Bonds are financial guarantees used mainly in construction contracts, ensuring contractors fulfill obligations. Both instruments are important for infrastructure financing and risk management.

Masala Bonds are rupee-denominated bonds issued overseas to attract foreign investors, with currency risk borne by investors. Surety Bonds are financial guarantees used mainly in construction contracts, ensuring contractors fulfill obligations. Both instruments are important for infrastructure financing and risk management.

Comparison: Masala Bonds vs Surety Bonds

| Aspect | Masala Bond | Surety Bond |

|---|---|---|

| Nature | Debt instrument (Rupee-denominated overseas bond) | Financial guarantee (3-party contract) |

| Purpose | Raise foreign funds for Indian projects | Guarantee contractor’s performance |

| Risk | Currency risk borne by investors | Performance risk covered by surety company |

| Issuer | Corporates, Indian banks, Govt agencies | Insurance companies (regulated by IRDAI) |

| Examples | Kerala KIIFB Masala Bond, NHAI Masala Bond | Performance Bonds in construction projects |

Mains Key Points

Prelims Strategy Tips

Electoral Bonds and Concept of Bond Yield

Electoral Bonds are banking instruments issued by SBI, introduced in 2018, to make political donations through a formal channel instead of cash. They are aimed at transparency but also criticized for donor anonymity. Bond Yield is the effective return on bonds, fluctuating with market price, and serves as an important indicator for economy, stock markets, currency, and borrowing costs.

Electoral Bonds are banking instruments issued by SBI, introduced in 2018, to make political donations through a formal channel instead of cash. They are aimed at transparency but also criticized for donor anonymity. Bond Yield is the effective return on bonds, fluctuating with market price, and serves as an important indicator for economy, stock markets, currency, and borrowing costs.

Comparison: Electoral Bonds vs Normal Bonds

| Aspect | Electoral Bond | Normal Bond |

|---|---|---|

| Issuer | State Bank of India | Government or Corporates |

| Purpose | Political donations | Borrowing & project financing |

| Denomination | ₹1,000 to ₹1 crore | Varies widely |

| Validity | 15 days only | Till maturity (1–30 years) |

| Interest | No interest | Fixed or variable coupon |

| Transparency | Opaque to public, known to Govt | Transparent to investors |

Mains Key Points

Prelims Strategy Tips

Bond Yield and Debentures

Bond Yield represents the effective return an investor earns from a bond, influenced by interest rates, inflation, and government borrowing. Debentures are long-term debt instruments issued by companies to borrow funds from the public at a fixed rate of interest, without collateral security.

Bond Yield represents the effective return an investor earns from a bond, influenced by interest rates, inflation, and government borrowing. Debentures are long-term debt instruments issued by companies to borrow funds from the public at a fixed rate of interest, without collateral security.

Shares vs Debentures

| Parameter | Shares | Debentures |

|---|---|---|

| Ownership | Represents ownership in company; voting rights included | Represents loan to company; no ownership |

| Risk | High risk, returns depend on company performance | Low risk, fixed interest irrespective of profits |

| Returns | Dividends (variable, not guaranteed) | Fixed interest (guaranteed unless company defaults) |

| Maturity | No maturity; can be held indefinitely | Fixed maturity; repaid after term |

| Priority in liquidation | Last priority after creditors | Higher priority, paid before shareholders |

Mains Key Points

Prelims Strategy Tips

Depositary Receipts (DR)

Depositary Receipts (DRs) are financial instruments issued by banks/financial institutions that represent ownership in shares of a foreign company. They allow investors to invest in overseas companies through their local stock exchanges without directly trading in foreign markets.

Depositary Receipts (DRs) are financial instruments issued by banks/financial institutions that represent ownership in shares of a foreign company. They allow investors to invest in overseas companies through their local stock exchanges without directly trading in foreign markets.

Types of Depositary Receipts

| Type | Issued In | Currency | Example |

|---|---|---|---|

| ADRs | United States | US Dollar | Alibaba (China) ADR in NYSE |

| GDRs | Outside US (London, Luxembourg) | Euro, GBP etc. | Vodafone Plc in LSE |

| IDRs | India | Indian Rupees | Standard Chartered Plc IDR in BSE |

Mains Key Points

Prelims Strategy Tips

Participatory Notes (P-Notes)

Participatory Notes (P-Notes), also known as Offshore Derivative Instruments (ODIs), are financial instruments issued by SEBI-registered Foreign Institutional Investors (FIIs) to overseas investors who want to invest in Indian stock markets without registering directly with SEBI. They provide an indirect route for foreign investments in India.

Participatory Notes (P-Notes), also known as Offshore Derivative Instruments (ODIs), are financial instruments issued by SEBI-registered Foreign Institutional Investors (FIIs) to overseas investors who want to invest in Indian stock markets without registering directly with SEBI. They provide an indirect route for foreign investments in India.

Key Aspects of Participatory Notes

| Aspect | Details |

|---|---|

| Issuer | SEBI-registered Foreign Institutional Investors (FIIs) |

| Holder | Overseas investors not directly registered with SEBI |

| Nature | Offshore Derivative Instrument (ODI) |

| Purpose | Indirect investment in Indian markets |

| Regulation | SEBI (tightened norms since 2007) |

Mains Key Points

Prelims Strategy Tips

Investment Funds

Investment Funds are financial arrangements that pool money from multiple investors and invest it in securities like shares, bonds, or other assets. Each investor owns units in the fund, which represent their share of ownership. These funds are managed professionally and help small investors participate in big markets.

Investment Funds are financial arrangements that pool money from multiple investors and invest it in securities like shares, bonds, or other assets. Each investor owns units in the fund, which represent their share of ownership. These funds are managed professionally and help small investors participate in big markets.

Comparison of Investment Funds

| Type | Key Features | Example |

|---|---|---|

| Mutual Fund | Pooled money, managed by AMC, high liquidity | HDFC Top 100 Fund |

| ETF | Traded on stock exchange, basket of securities | Bharat 22 ETF |

| Bharat Bond ETF | Corporate bond ETF, safe AAA bonds, fixed maturity | Launched 2019 by Edelweiss AMC |

Mains Key Points

Prelims Strategy Tips

Hedge Funds and Real Estate Investment Trusts (REITs)

Hedge Funds are alternative investment funds that pool money from High Net Worth Individuals (HNIs) to invest in risky and complex products like equities, bonds, currencies, and derivatives. Real Estate Investment Trusts (REITs) are investment vehicles that allow small and large investors to invest in income-generating real estate properties, much like mutual funds but focused on real estate.

Hedge Funds are alternative investment funds that pool money from High Net Worth Individuals (HNIs) to invest in risky and complex products like equities, bonds, currencies, and derivatives. Real Estate Investment Trusts (REITs) are investment vehicles that allow small and large investors to invest in income-generating real estate properties, much like mutual funds but focused on real estate.

Comparison: Hedge Funds vs REITs

| Aspect | Hedge Funds | REITs |

|---|---|---|

| Target Investors | HNIs, Institutions | Retail + Institutional investors |

| Investment Focus | Equities, bonds, currencies, derivatives, commodities | Real estate assets (offices, malls, apartments) |

| Risk | High (risky and speculative) | Moderate (real estate income is stable) |

| Liquidity | Low (lock-in, less tradable) | High (units listed on stock exchange) |

| Returns | High but risky, not guaranteed | Stable income + capital appreciation |

| Regulation | Regulated by SEBI as Alternative Investment Funds (AIFs) | Regulated by SEBI, listed on NSE/BSE |

Mains Key Points

Prelims Strategy Tips

Investment Trusts (InvITs), Venture Capital (VC) and Seed Money

InvITs are collective investment vehicles like REITs but focus on infrastructure projects. Venture Capital is funding given to high-risk startups with high growth potential in exchange for equity ownership. Seed Money is the earliest stage of funding provided to a new business idea before it becomes self-sustainable.

InvITs are collective investment vehicles like REITs but focus on infrastructure projects. Venture Capital is funding given to high-risk startups with high growth potential in exchange for equity ownership. Seed Money is the earliest stage of funding provided to a new business idea before it becomes self-sustainable.

Comparison of InvIT, Venture Capital and Seed Money

| Aspect | InvIT | Venture Capital (VC) | Seed Money |

|---|---|---|---|

| Focus | Infrastructure projects | Early-stage startups with high growth potential | Earliest funding for a new idea/startup |

| Return | Revenue/profits from infra projects (toll, tariff) | Equity stake (share of profit when startup grows) | Equity stake in very early stage |

| Investor Type | Retail + Institutional | VC firms, HNIs, private equity | Angel investors, family, friends, seed funds |

| Risk | Moderate (depends on infra project success) | High (startups may fail) | Very High (idea may not even take off) |

| Liquidity | Units tradable on stock exchanges | Equity, not liquid until exit/IPO | Not liquid until bigger investment round |

Mains Key Points

Prelims Strategy Tips

Types of Investors in Financial Markets

Investors in financial markets can be classified into different types based on their size, knowledge, strategy, and purpose. Some are very large institutions like mutual funds and insurance companies, while some are individual investors like angel investors, bulls, and bears. Each type of investor plays a unique role in creating liquidity, providing capital, and influencing the movement of prices in the stock market.

Investors in financial markets can be classified into different types based on their size, knowledge, strategy, and purpose. Some are very large institutions like mutual funds and insurance companies, while some are individual investors like angel investors, bulls, and bears. Each type of investor plays a unique role in creating liquidity, providing capital, and influencing the movement of prices in the stock market.

Types of Investors – Key Comparison

| Investor Type | Main Feature | Example |

|---|---|---|

| QII | Large domestic institutions with expertise and big funds | LIC, SBI Mutual Fund |

| FII | Foreign-based institutions investing in Indian markets | Singapore Mutual Fund buying Infosys |

| Angel Investor | HNIs investing in startups + providing mentorship | Investors in Ola, Flipkart |

| Jobber | Market makers providing liquidity | Dealers at NSE/BSE |

| Stag | Short-term IPO profit seekers | Selling Zomato shares after listing |

| Bull | Optimistic investors expecting price rise | Buying HDFC shares expecting 2000 price |

| Bear | Pessimistic investors expecting price fall | Selling CCD shares at 60 expecting 50 |

Mains Key Points

Prelims Strategy Tips

Stock Exchange and Indices

A stock exchange is a marketplace where buyers and sellers trade securities such as shares, bonds, and derivatives. The prices of these securities are driven by demand and supply. To be traded, securities must be listed on the exchange. Stock indices like Sensex and Nifty reflect the performance of a selected group of companies and indicate the overall health of the economy.

A stock exchange is a marketplace where buyers and sellers trade securities such as shares, bonds, and derivatives. The prices of these securities are driven by demand and supply. To be traded, securities must be listed on the exchange. Stock indices like Sensex and Nifty reflect the performance of a selected group of companies and indicate the overall health of the economy.

Comparison of BSE and NSE

| Feature | BSE (Bombay Stock Exchange) | NSE (National Stock Exchange) |

|---|---|---|

| Year Established | 1875 (Oldest in Asia) | 1992 (First fully electronic exchange) |

| Main Index | SENSEX (30 companies) | NIFTY 50 (50 companies) |

| Global Link | India INX in GIFT City | International link through NSE IFSC |

| Technology | Traditional but now fully electronic | Born as a fully automated exchange |

Mains Key Points

Prelims Strategy Tips

Social Stock Exchange (SSE)

A Social Stock Exchange is a special platform approved by SEBI in 2022 to help social enterprises (for-profit and not-for-profit) raise funds. It works like a stock exchange but focuses on social and development projects, ensuring better transparency and organized utilization of funds.

A Social Stock Exchange is a special platform approved by SEBI in 2022 to help social enterprises (for-profit and not-for-profit) raise funds. It works like a stock exchange but focuses on social and development projects, ensuring better transparency and organized utilization of funds.

Comparison: Normal Stock Exchange vs Social Stock Exchange

| Aspect | Normal Stock Exchange | Social Stock Exchange (SSE) |

|---|---|---|

| Purpose | Raise capital for business profits | Raise funds for social and development impact |

| Eligible Entities | For-profit companies | For-profit + Not-for-profit enterprises |

| Instruments | Shares, Bonds, Derivatives | Equity, Debt, ZCZP Bonds, Social Impact Funds |

| Regulator | SEBI | SEBI (with special norms for SSE) |

Mains Key Points

Prelims Strategy Tips

Securities and Exchange Board of India (SEBI)

SEBI is the regulator of the securities and capital market in India. Formed in 1988 and made a statutory body in 1992, SEBI protects investors’ interests, regulates market participants (like brokers, companies, fund managers), and ensures fair functioning of stock exchanges.

SEBI is the regulator of the securities and capital market in India. Formed in 1988 and made a statutory body in 1992, SEBI protects investors’ interests, regulates market participants (like brokers, companies, fund managers), and ensures fair functioning of stock exchanges.

SEBI – Quick Facts

| Aspect | Details |

|---|---|

| Formation Year | 1988 (Statutory in 1992) |

| Headquarters | Mumbai |

| Chairman Tenure | 5 years / 65 years age limit |

| Composition | Chairman + 1 RBI officer + 2 Union Govt officers + 5 members nominated by Govt |

| Appeal Body | Securities Appellate Tribunal (SAT), further appeal in Supreme Court |

Mains Key Points

Prelims Strategy Tips

Reforms in Bond Market

India’s bond market reforms aim to deepen financial markets, boost retail participation, and connect government bonds with corporate bonds. Recent reforms include unified bond market, setting up a bond-buying institution, and RBI’s Retail Direct Scheme.

India’s bond market reforms aim to deepen financial markets, boost retail participation, and connect government bonds with corporate bonds. Recent reforms include unified bond market, setting up a bond-buying institution, and RBI’s Retail Direct Scheme.

Major Bond Market Reforms

| Reform | Details |

|---|---|

| Unified Bond Market | Single platform for both G-Secs and corporate bonds (SEBI proposal, 2020). |

| Bond-Buying Institution | Body to buy investment-grade bonds during normal and stressed times (Budget 2021). |

| Retail Direct Scheme | RBI initiative (2021) for retail investors to buy G-Secs, SDLs, and SGBs directly. |

Mains Key Points

Prelims Strategy Tips

Commodities Market

The commodities market is a platform where raw materials and goods like grains, metals, oil, and cotton are traded in bulk. It helps producers and consumers manage price risks through spot and futures trading.

The commodities market is a platform where raw materials and goods like grains, metals, oil, and cotton are traded in bulk. It helps producers and consumers manage price risks through spot and futures trading.

Types of Commodity Markets

| Market Type | Explanation | Example |

|---|---|---|

| Spot Market | Immediate buying and selling of commodities with instant delivery. | Farmer selling wheat at mandi to a buyer. |

| Futures Market | Contracts to buy/sell commodities at a fixed price for future delivery. | Gold jewellery maker fixes price today for delivery after 6 months. |

Mains Key Points

Prelims Strategy Tips

Gold Exchanges and Water Trading

Gold exchanges are specialized commodity markets for gold trading regulated by SEBI, while Electronic Gold Receipts (EGRs) provide a digital way of owning gold. Water trading is a new concept where water rights can be bought and sold, similar to commodities like gold and oil.

Gold exchanges are specialized commodity markets for gold trading regulated by SEBI, while Electronic Gold Receipts (EGRs) provide a digital way of owning gold. Water trading is a new concept where water rights can be bought and sold, similar to commodities like gold and oil.

Gold Exchanges vs Water Trading

| Aspect | Gold Exchange | Water Trading |

|---|---|---|

| Focus | Trading only in Gold | Trading of water rights |

| Regulator | SEBI + WDRA | Policy under NITI Aayog (Draft stage in India) |

| Instrument | Electronic Gold Receipts (EGRs) | Water rights / entitlements |

| Global Practice | Standardized worldwide commodity | Practiced in Australia, Chile, USA |

| Example | Investor buys gold digitally & redeems it later | Farmer sells surplus water rights to industries |

Mains Key Points

Prelims Strategy Tips

Key Terms Related to Financial Markets

Financial markets have several unique practices and instruments. Some of them, like Dabba Trading and Insider Trading, are illegal. Others, like Algo-Trading and Employee Stock Option Plans (ESOPs), are legitimate but need regulation. Understanding these terms helps investors avoid risks and make informed decisions.

Financial markets have several unique practices and instruments. Some of them, like Dabba Trading and Insider Trading, are illegal. Others, like Algo-Trading and Employee Stock Option Plans (ESOPs), are legitimate but need regulation. Understanding these terms helps investors avoid risks and make informed decisions.

Legitimate vs. Illegal Practices in Financial Markets

| Term | Nature | Risk |

|---|---|---|

| Dabba Trading | Illegal | Investor has no legal protection; prone to scams |

| Algo-Trading | Legal but regulated | Market manipulation, sudden crashes possible |

| Insider Trading | Illegal | Unfair advantage, punishable by SEBI |

| ESOP | Legal | Loyalty booster but may dilute ownership |

| Penny Stocks | Legal but risky | Highly volatile; subject to fraud |

Mains Key Points

Prelims Strategy Tips

Case Studies – Insider Trading Scams

Insider trading scandals highlight how misuse of confidential information can shake investor confidence and destabilize markets. Learning from these cases is crucial for regulatory strengthening.

Insider trading scandals highlight how misuse of confidential information can shake investor confidence and destabilize markets. Learning from these cases is crucial for regulatory strengthening.

Famous Insider Trading Cases

| Case | Year | Country | Outcome |

|---|---|---|---|

| Rakesh Agrawal vs SEBI | 1994 | India | First SEBI action; penalty on Bayer |

| HLL–BBLIL Merger Case | 1996 | India | SEBI reversed trades; set corporate accountability precedent |

| Martha Stewart & ImClone | 2001 | USA | Conviction for obstruction; highlighted strict US enforcement |

| Rajat Gupta & Rajaratnam | 2012 | USA | Prison sentences; one of USA’s biggest insider trading scandals |

Mains Key Points

Prelims Strategy Tips

Chapter Complete!

Ready to move to the next chapter?