Economics Playlist

18 chapters • 0 completed

Introduction to Economics

10 topics

National Income

17 topics

Inclusive growth

15 topics

Inflation

21 topics

Money

15 topics

Banking

38 topics

Monetary Policy

15 topics

Investment Models

9 topics

Food Processing Industries

9 topics

Taxation

28 topics

Budgeting and Fiscal Policy

24 topics

Financial Market

34 topics

External Sector

37 topics

Industries

21 topics

Land Reforms in India

16 topics

Poverty, Hunger and Inequality

24 topics

Planning in India

16 topics

Unemployment

17 topics

Chapter 7: Monetary Policy

Chapter TestMonetary Policy

Monetary policy is the use of tools by a country’s central bank (in India, the RBI) to regulate money supply, control inflation, promote growth, and ensure economic stability. It works alongside fiscal policy, but is independent in nature.

Monetary policy is the use of tools by a country’s central bank (in India, the RBI) to regulate money supply, control inflation, promote growth, and ensure economic stability. It works alongside fiscal policy, but is independent in nature.

Goals of Monetary Policy

| Goal | Explanation | Example |

|---|---|---|

| Control Inflation | Reduce money supply when prices rise | Raise repo rate to reduce borrowing |

| Economic Growth | Stimulate demand and investment | Lower repo rate during slowdown |

| Reduce Unemployment | More jobs via expansionary credit policies | Cheaper loans encourage hiring |

| Exchange Rate Stability | RBI intervenes in forex market | Selling dollars to strengthen rupee |

Mains Key Points

Prelims Strategy Tips

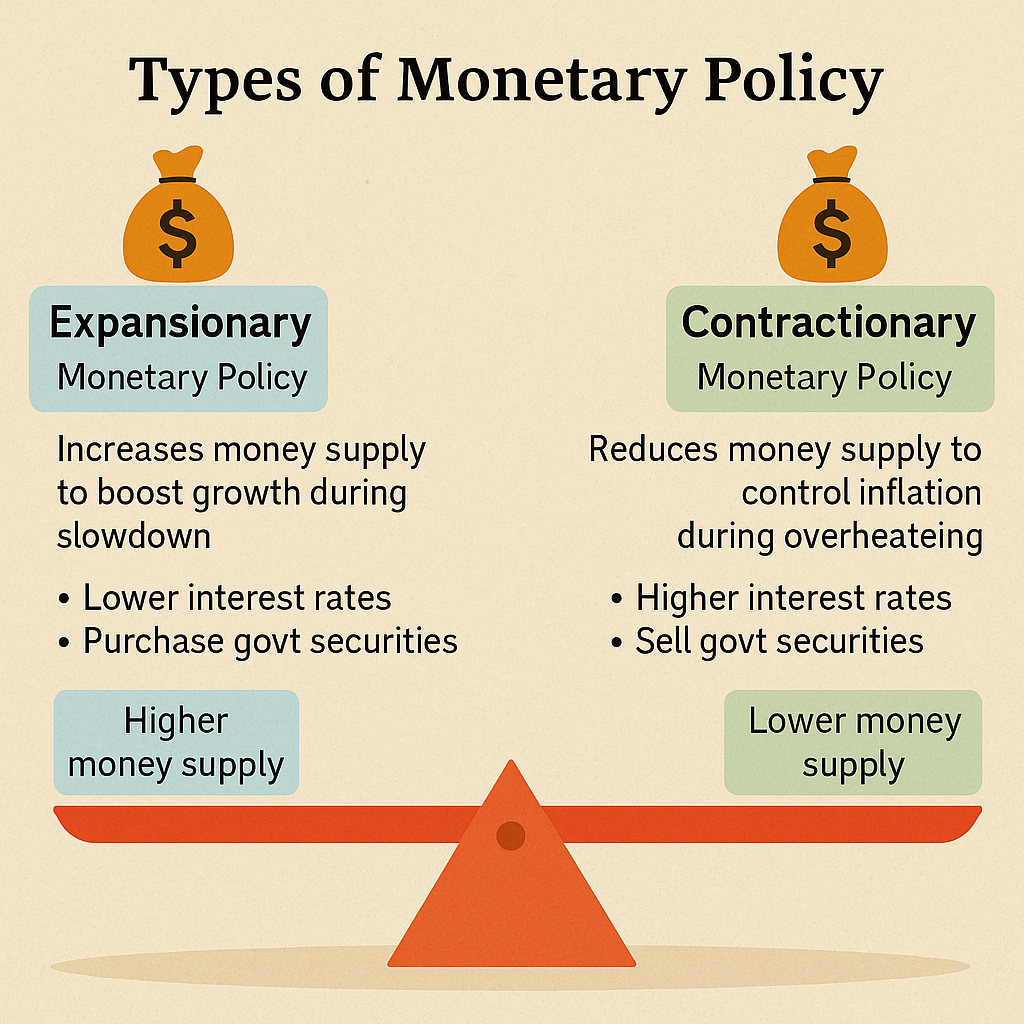

Types of Monetary Policy

There are two main types of monetary policy: Expansionary and Contractionary. Expansionary policy increases money supply to boost growth during slowdowns, while Contractionary policy reduces money supply to control inflation during overheating of the economy.

There are two main types of monetary policy: Expansionary and Contractionary. Expansionary policy increases money supply to boost growth during slowdowns, while Contractionary policy reduces money supply to control inflation during overheating of the economy.

Types of Monetary Policy – Comparison

| Aspect | Expansionary Policy | Contractionary Policy |

|---|---|---|

| Purpose | Boost growth during slowdown | Control inflation during overheating |

| Money Supply | Increases | Decreases |

| Interest Rates | Lowered | Raised |

| Reserve Requirements | Reduced (Lower CRR/SLR) | Increased (Higher CRR/SLR) |

| Govt Securities | Purchased (injects money) | Sold (absorbs money) |

Mains Key Points

Prelims Strategy Tips

Monetary Policy Framework in India

The Monetary Policy Framework is the system through which the Reserve Bank of India (RBI) manages money supply, credit, and inflation in the economy. Its main goal is to keep inflation under control while also ensuring enough money is available for economic growth. Since 2016, India follows a Flexible Inflation Targeting (FIT) framework where the inflation target is set for 5 years.

The Monetary Policy Framework is the system through which the Reserve Bank of India (RBI) manages money supply, credit, and inflation in the economy. Its main goal is to keep inflation under control while also ensuring enough money is available for economic growth. Since 2016, India follows a Flexible Inflation Targeting (FIT) framework where the inflation target is set for 5 years.

Inflation Target Framework in India

| Period | Target Inflation | Tolerance Band | Remarks |

|---|---|---|---|

| 2016–2021 | 4% CPI | ±2% (2-6%) | First official inflation target under FIT framework |

| 2021–2026 | 4% CPI | ±2% (2-6%) | Target retained for next 5 years |

Mains Key Points

Prelims Strategy Tips

Monetary Policy Committee (MPC)

The Monetary Policy Committee (MPC) is a six-member body formed under Section 45ZB of the amended RBI Act, 1934. It was first set up in September 2016. The MPC decides the policy repo rate needed to achieve the inflation target (currently 4% CPI within 2-6% band). It meets at least 4 times a year, usually once every two months.

The Monetary Policy Committee (MPC) is a six-member body formed under Section 45ZB of the amended RBI Act, 1934. It was first set up in September 2016. The MPC decides the policy repo rate needed to achieve the inflation target (currently 4% CPI within 2-6% band). It meets at least 4 times a year, usually once every two months.

Monetary Policy Committee (MPC) Composition

| Member | Nominated By | Details |

|---|---|---|

| RBI Governor | RBI | Chairperson, ex-officio |

| RBI Deputy Governor | RBI | Ex-officio member |

| One member from RBI Central Board | RBI | Nominated by RBI Board |

| Three external members | Central Govt | Selected for 4 years, no reappointment |

Mains Key Points

Prelims Strategy Tips

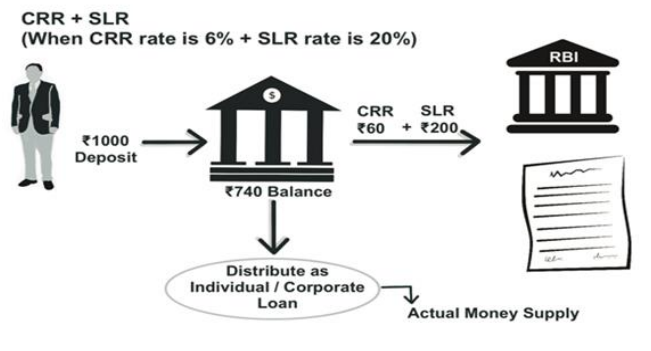

Instruments of Monetary Policy – Quantitative Tools

Quantitative tools of monetary policy are used by the RBI to control the overall supply of money and credit in the economy. The most important among them are Repo Rate, Reverse Repo Rate, Bank Rate, Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), and Open Market Operations (OMO).

Quantitative tools of monetary policy are used by the RBI to control the overall supply of money and credit in the economy. The most important among them are Repo Rate, Reverse Repo Rate, Bank Rate, Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), and Open Market Operations (OMO).

Comparison: CRR vs. SLR

| Aspect | CRR | SLR |

|---|---|---|

| Definition | Minimum cash % of deposits kept with RBI | Minimum % of deposits in cash, gold, or approved securities kept by banks themselves |

| Legal Basis | RBI Act, 1934 | Banking Regulation Act, 1949 |

| Where Held | With RBI | With Banks themselves |

| Interest | No interest paid by RBI | Banks can earn some interest on securities |

| Current Rate | 4.5% of NDTL | 18% of NDTL |

| Limit | No fixed maximum, but not 100% | Cannot exceed 40% |

Mains Key Points

Prelims Strategy Tips

CRR, SLR, SDF and LAF in Monetary Policy

CRR and SLR are statutory reserve requirements that directly affect money supply, interest rates, and economic activity. RBI also uses new tools like the Standing Deposit Facility (SDF) and Liquidity Adjustment Facility (LAF) to manage liquidity, inflation, and stability in the financial system.

CRR and SLR are statutory reserve requirements that directly affect money supply, interest rates, and economic activity. RBI also uses new tools like the Standing Deposit Facility (SDF) and Liquidity Adjustment Facility (LAF) to manage liquidity, inflation, and stability in the financial system.

Effect of CRR/SLR on Inflation & Growth

| Condition | Impact on Banks | Impact on Economy |

|---|---|---|

| CRR/SLR Increases | Less money to lend, higher interest rates | Reduced borrowing, demand falls, inflation decreases |

| CRR/SLR Decreases | More money to lend, lower interest rates | More borrowing, demand rises, growth increases (but risk of inflation) |

Comparison: SDF vs Reverse Repo vs LAF

| Aspect | SDF | Reverse Repo | LAF |

|---|---|---|---|

| Introduced | 2022 | 2000 (LAF toolkit) | 2000 |

| Collateral | No collateral required | RBI provides collateral (G-Secs) | G-Secs required |

| Position | Floor of LAF corridor | Part of LAF toolkit | Umbrella facility |

| Purpose | Absorb large liquidity quickly | Absorb day-to-day liquidity | Daily liquidity adjustment |

Mains Key Points

Prelims Strategy Tips

Liquidity Adjustment Facility (LAF) and Inflation Control

LAF is a mechanism used by RBI to manage short-term liquidity in the economy through Repo and Reverse Repo rates. By adjusting these rates, RBI influences the cost of borrowing for banks, which directly affects lending rates, demand for credit, and ultimately inflation or growth.

LAF is a mechanism used by RBI to manage short-term liquidity in the economy through Repo and Reverse Repo rates. By adjusting these rates, RBI influences the cost of borrowing for banks, which directly affects lending rates, demand for credit, and ultimately inflation or growth.

Repo vs Reverse Repo – Impact on Inflation

| Tool | When Increased | When Decreased |

|---|---|---|

| Repo Rate | Borrowing costly → demand falls → inflation reduces | Borrowing cheap → demand rises → growth increases |

| Reverse Repo Rate | Banks park more funds with RBI → less lending → inflation reduces | Banks park less with RBI → more lending → growth increases |

Repo Rate Changes (2019–2023)

| Period | Change in Repo Rate | Reason |

|---|---|---|

| Feb 2019 – May 2020 | Reduced from 6.25% → 4% (225 bps cut) | Economic slowdown after GST & Demonetisation |

| May 2020 – Apr 2022 | Maintained at 4% | COVID lockdown and negative GDP growth |

| May 2022 – Feb 2023 | Increased from 4% → 6.5% (250 bps hike) | High inflation due to supply chain issues & Ukraine-Russia war |

Mains Key Points

Prelims Strategy Tips

Reverse Repo Rate, MSF and Open Market Operations (OMO)

Reverse Repo, MSF, and OMO are important instruments of RBI’s monetary policy to control liquidity and inflation. They influence how much money is available in the market, thereby affecting inflation, growth, and stability of the financial system.

Reverse Repo, MSF, and OMO are important instruments of RBI’s monetary policy to control liquidity and inflation. They influence how much money is available in the market, thereby affecting inflation, growth, and stability of the financial system.

Comparison: Reverse Repo vs MSF vs OMO

| Instrument | Meaning | Purpose | Position in LAF Corridor |

|---|---|---|---|

| Reverse Repo | Rate RBI pays to banks when they park funds | Absorb excess liquidity, control inflation | Floor (lower bound) |

| MSF | Penal overnight borrowing from RBI against G-Secs (up to 2%) | Emergency liquidity support | Ceiling (upper bound) |

| OMO | Buying & selling of Govt. Securities in open market | Inject or absorb liquidity as per need | Not part of corridor but used flexibly |

Mains Key Points

Prelims Strategy Tips

Other Monetary Policy Measures by RBI

Apart from Repo, Reverse Repo, CRR, and SLR, RBI uses additional instruments like Variable Rate Reverse Repo (VRRR), Bank Rate, and Operation Twist to manage liquidity, inflation, and interest rates in the economy. These tools help in fine-tuning monetary policy and ensuring better transmission to markets and banks.

Apart from Repo, Reverse Repo, CRR, and SLR, RBI uses additional instruments like Variable Rate Reverse Repo (VRRR), Bank Rate, and Operation Twist to manage liquidity, inflation, and interest rates in the economy. These tools help in fine-tuning monetary policy and ensuring better transmission to markets and banks.

Comparison of VRRR, Bank Rate, and Operation Twist

| Instrument | Year Introduced | Purpose | Key Feature |

|---|---|---|---|

| VRRR | 2021 | Absorb excess liquidity via auctions | Banks bid rates below repo rate on e-KUBER |

| Bank Rate | 1934 (RBI Act) | Earlier – long-term lending rate; Now – penal rate | Aligned with MSF, automatic change |

| Operation Twist | 1961 (US), 2019 (India) | Reduce long-term G-Sec yields, deepen bond market | Simultaneous buying (long-term) & selling (short-term) of G-Secs |

Mains Key Points

Prelims Strategy Tips

Retail Direct Scheme, G-SAP, Special Repo Windows & LAF Corridor

RBI has recently introduced innovative measures like Retail Direct Scheme (direct G-Sec access for retail investors), Government Securities Acquisition Programme (G-SAP), Long Term Repo Operations (LTRO variants), and special On-Tap liquidity windows during COVID. Alongside, the LAF Corridor framework ensures stability in liquidity management by defining the relationship between Repo, MSF, and SDF.

RBI has recently introduced innovative measures like Retail Direct Scheme (direct G-Sec access for retail investors), Government Securities Acquisition Programme (G-SAP), Long Term Repo Operations (LTRO variants), and special On-Tap liquidity windows during COVID. Alongside, the LAF Corridor framework ensures stability in liquidity management by defining the relationship between Repo, MSF, and SDF.

Comparison of OMO, Operation Twist, and G-SAP

| Instrument | Mechanism | Purpose | Schedule |

|---|---|---|---|

| OMO | RBI buys/sells G-Secs | Control inflation/deflation | Not pre-announced |

| Operation Twist | Buy long-term, Sell short-term G-Secs | Reduce long-term yields, make borrowing cheaper | Not fixed, tactical |

| G-SAP | RBI buys G-Secs only | Infuse liquidity post-COVID revival | Pre-announced schedule |

Mains Key Points

Prelims Strategy Tips

Marginal Standing Facility (MSF) and Open Market Operations (OMO)

MSF is an emergency borrowing facility for banks at a penal interest rate, introduced in 2011 as the ceiling of the LAF corridor. OMO is RBI’s regular tool to inject or absorb liquidity by buying/selling government securities in the market.

MSF is an emergency borrowing facility for banks at a penal interest rate, introduced in 2011 as the ceiling of the LAF corridor. OMO is RBI’s regular tool to inject or absorb liquidity by buying/selling government securities in the market.

MSF vs OMO

| Feature | MSF | OMO |

|---|---|---|

| Introduction | 2011 | Long-standing RBI tool |

| Purpose | Emergency borrowing for banks | Liquidity management in economy |

| Rate | 25 bps above Repo (penal) | Market-driven (depends on buy/sell G-Secs) |

| Collateral | Banks pledge G-Secs (up to 2% of SLR) | RBI directly buys/sells G-Secs |

| Usage | Last resort in crisis | Regularly used depending on inflation/growth needs |

Mains Key Points

Prelims Strategy Tips

Qualitative Tools of Monetary Policy

Unlike quantitative tools (CRR, SLR, Repo, OMO), which change the overall money supply in the economy, qualitative tools are selective. They guide or control the flow of credit towards or away from certain sectors or activities. These are also called Direct or Selective Instruments of RBI’s monetary policy.

Unlike quantitative tools (CRR, SLR, Repo, OMO), which change the overall money supply in the economy, qualitative tools are selective. They guide or control the flow of credit towards or away from certain sectors or activities. These are also called Direct or Selective Instruments of RBI’s monetary policy.

Quantitative vs Qualitative Tools

| Aspect | Quantitative Tools | Qualitative Tools |

|---|---|---|

| Definition | Control overall money supply | Control direction of credit |

| Examples | CRR, SLR, Repo, OMO | Margin Requirements, Moral Suasion |

| Focus | Entire economy | Specific sectors/activities |

| Nature | Indirect, volume-based | Direct, selective |

| Impact | Affects inflation, growth | Affects allocation of credit |

Mains Key Points

Prelims Strategy Tips

Priority Sector Lending (PSL)

Priority Sector Lending (PSL) is a policy of the Reserve Bank of India (RBI) under which banks are mandated to provide a certain portion of their loans to specific sectors of the economy that are considered essential for the country’s growth, welfare, and inclusive development. These sectors include agriculture, micro-enterprises, weaker sections, housing, education, and renewable energy.

Priority Sector Lending (PSL) is a policy of the Reserve Bank of India (RBI) under which banks are mandated to provide a certain portion of their loans to specific sectors of the economy that are considered essential for the country’s growth, welfare, and inclusive development. These sectors include agriculture, micro-enterprises, weaker sections, housing, education, and renewable energy.

PSL Targets for Banks

| Bank Type | Target |

|---|---|

| Domestic Commercial Banks | 40% of ANBC |

| Foreign Banks (≥20 branches) | 40% of ANBC |

| Foreign Banks (<20 branches) | 40% of ANBC |

| Regional Rural Banks (RRBs) | 75% of ANBC |

| Small Finance Banks | 75% of ANBC |

| Urban Cooperative Banks | 75% of ANBC (by March 31, 2024) |

PSL Sectoral Targets for Commercial Banks

| Sector | Target |

|---|---|

| Agriculture | 18% (10% for small & marginal farmers) |

| Micro Enterprises | 7.5% |

| Weaker Sections | 12% |

| Other Sectors (Education, Housing, Social Infra, Export Credit, Renewable Energy) | 2.5% |

| Total | 40% of ANBC |

Mains Key Points

Prelims Strategy Tips

PSL Certificates and Assessment of RBI’s Monetary Policy

PSL Certificates were introduced in 2016 to allow banks that exceed their Priority Sector Lending (PSL) targets to sell surplus lending as 'certificates' to banks that fall short. RBI’s monetary policy framework has achieved progress in growth support, inflation targeting, and transmission reforms, but faces challenges in effective implementation due to structural and external constraints.

PSL Certificates were introduced in 2016 to allow banks that exceed their Priority Sector Lending (PSL) targets to sell surplus lending as 'certificates' to banks that fall short. RBI’s monetary policy framework has achieved progress in growth support, inflation targeting, and transmission reforms, but faces challenges in effective implementation due to structural and external constraints.

CPI vs WPI as Inflation Indicators

| Aspect | CPI | WPI |

|---|---|---|

| Coverage | Household consumption basket | Wider coverage, incl. tradeables |

| Timeliness | Available with longer lag | Available faster |

| Geography | Constructed for centres/regions | Pan-India |

| Focus | Retail prices (consumers) | Wholesale prices (traders, producers) |

Mains Key Points

Prelims Strategy Tips

How RBI Influences Bank’s Interest Rates

RBI influences lending rates of banks through different regulatory frameworks. Over time, India has moved from the Base Rate (2010) → MCLR (2016) → External Benchmark Linked Lending Rate (2019). This ensures better and faster transmission of RBI’s policy rate changes (like repo rate) to the borrowers.

RBI influences lending rates of banks through different regulatory frameworks. Over time, India has moved from the Base Rate (2010) → MCLR (2016) → External Benchmark Linked Lending Rate (2019). This ensures better and faster transmission of RBI’s policy rate changes (like repo rate) to the borrowers.

Evolution of Lending Rate Framework

| System | Year Introduced | Features | Limitations |

|---|---|---|---|

| Base Rate / BPLR | 2010 | Minimum rate below which no loan can be given | Slow transmission, not transparent enough |

| MCLR | 2016 | Based on repo rate, costs, CRR, tenor premium | Delay in passing repo changes to customers |

| External Benchmark Rate | 2019 | Linked to repo, T-bills or FBIL benchmark; review every 3 months | More transparent and faster, but banks can add spread |

Mains Key Points

Prelims Strategy Tips

Chapter Complete!

Ready to move to the next chapter?