Economics Playlist

18 chapters • 0 completed

Introduction to Economics

10 topics

National Income

17 topics

Inclusive growth

15 topics

Inflation

21 topics

Money

15 topics

Banking

38 topics

Monetary Policy

15 topics

Investment Models

9 topics

Food Processing Industries

9 topics

Taxation

28 topics

Budgeting and Fiscal Policy

24 topics

Financial Market

34 topics

External Sector

37 topics

Industries

21 topics

Land Reforms in India

16 topics

Poverty, Hunger and Inequality

24 topics

Planning in India

16 topics

Unemployment

17 topics

Chapter 5: Money

Chapter TestMoney – Meaning and Functions

Money is anything that is generally accepted as a medium of exchange, a measure of value, a store of wealth, and a standard for deferred payments. It makes trade and economic activity easier by eliminating the limitations of barter system.

Money is anything that is generally accepted as a medium of exchange, a measure of value, a store of wealth, and a standard for deferred payments. It makes trade and economic activity easier by eliminating the limitations of barter system.

Functions of Money

| Type | Function | Example |

|---|---|---|

| Primary | Medium of Exchange | Buying groceries with ₹500 note |

| Primary | Measure of Value | A pen costs ₹20, a shirt costs ₹500 |

| Secondary | Store of Value | Saving ₹1000 in wallet for future use |

| Secondary | Deferred Payments | Paying back a loan in instalments |

| Secondary | Transfer of Value | Sending money online to another city |

| Other | Distribution of National Income | Wages, rent, interest paid in money |

| Other | Liquidity | Breaking ₹500 note into smaller denominations |

| Other | Uniformity of Value | Comparing value of rice and petrol using ₹ |

Prelims Strategy Tips

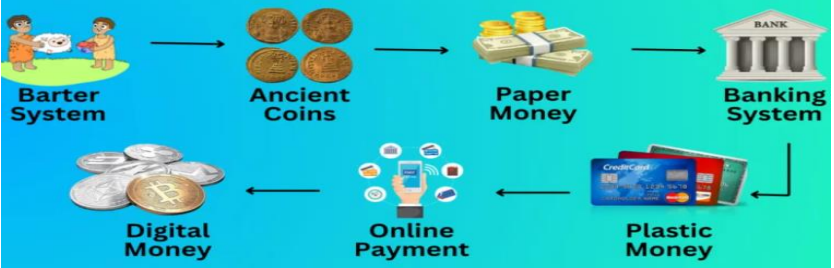

Commodity Money and Barter System

Before the invention of modern currency, trade was carried out using commodity money and barter system. Commodity money had intrinsic value, while barter involved direct exchange of goods and services.

Before the invention of modern currency, trade was carried out using commodity money and barter system. Commodity money had intrinsic value, while barter involved direct exchange of goods and services.

Comparison: Commodity Money vs Barter System

| Aspect | Commodity Money | Barter System |

|---|---|---|

| Definition | Physical item with intrinsic value used as money | Direct exchange of goods/services without money |

| Value | Has intrinsic value (e.g., gold, cocoa beans) | Depends on mutual agreement |

| Challenges | Perishable, bulky, limited trade | Double coincidence of wants problem |

| Use in History | Used in early civilizations | Dominant before invention of money |

| Modern Relevance | Rare, replaced by currency | Still used in B2B & international trade |

Mains Key Points

Prelims Strategy Tips

Demerits of Barter System & Evolution to Metallic Money

Barter system, though historically important, faced multiple limitations such as lack of common measurement, double coincidence of wants, and storage issues. To overcome these, societies gradually shifted to metallic standards (gold/silver) and coinage systems.

Barter system, though historically important, faced multiple limitations such as lack of common measurement, double coincidence of wants, and storage issues. To overcome these, societies gradually shifted to metallic standards (gold/silver) and coinage systems.

Comparison: Barter vs Metallic Money

| Aspect | Barter System | Metallic Money |

|---|---|---|

| Unit of Value | No common unit | Gold/Silver weight as standard |

| Divisibility | Difficult to divide goods | Coins easily divisible |

| Storage | Perishable goods lose value | Metals durable and storable |

| Trade | Limited to small/local trades | Facilitates large-scale trade |

| International Trade | Not feasible | Universally acceptable metals |

Mains Key Points

Prelims Strategy Tips

Paper Currency Standard & Legal Tender

Under the Paper Currency Standard, the central bank issues currency notes and coins as legal tender. Modern money is mostly Fiat Money – it has no intrinsic value and is valid because the government declares it so.

Under the Paper Currency Standard, the central bank issues currency notes and coins as legal tender. Modern money is mostly Fiat Money – it has no intrinsic value and is valid because the government declares it so.

Types of Legal Tender

| Aspect | Limited Legal Tender | Unlimited Legal Tender |

|---|---|---|

| Form | Coins | Currency Notes |

| Acceptance | Can be refused beyond a limit | Cannot be refused for any debt |

| Debt Settlement | Only for limited amount | Any amount of debt |

| Issuer | Government (under Coinage Act) | RBI (except ₹1 note by Govt.) |

| Restriction Example | Not beyond certain value | Finance Act 2017 – Cash > ₹2 lakh restricted |

Mains Key Points

Prelims Strategy Tips

Issuance of Bank Notes: Process and Procedure

In India, the Reserve Bank of India (RBI) has the sole authority to issue banknotes under the RBI Act, 1934, while the Central Government has the power to mint coins under the Coinage Act, 2011. Both institutions work together to decide on design, form, and circulation of currency.

In India, the Reserve Bank of India (RBI) has the sole authority to issue banknotes under the RBI Act, 1934, while the Central Government has the power to mint coins under the Coinage Act, 2011. Both institutions work together to decide on design, form, and circulation of currency.

Issuance of Banknotes and Coins in India

| Aspect | Banknotes | Coins |

|---|---|---|

| Authority | RBI (Section 22, RBI Act 1934) | Central Government (Coinage Act 2011) |

| Approval | Design approved by RBI Board + Central Govt. | Design approved by Govt. alone |

| Distribution | RBI manages supply via banks | RBI distributes, Govt. mints |

| Facilities | Printed at RBI-managed presses | Minted at Mumbai, Hyderabad, Kolkata, Noida |

| Recent Development | Withdrawal of ₹2000 notes in 2023 (still legal tender) | ₹1, ₹2, ₹5, ₹10 coins continue |

Mains Key Points

Prelims Strategy Tips

Bank Money / Deposit Money and Digital Payments

Bank money refers to balances held in savings or current accounts in commercial banks, which can be used for transactions via cheques, drafts, or overdrafts. With technological progress, electronic and digital payments (NEFT, IMPS, RTGS) have become the backbone of India’s modern payment system.

Bank money refers to balances held in savings or current accounts in commercial banks, which can be used for transactions via cheques, drafts, or overdrafts. With technological progress, electronic and digital payments (NEFT, IMPS, RTGS) have become the backbone of India’s modern payment system.

Comparison of Digital Payment Modes

| Aspect | NEFT | IMPS | RTGS |

|---|---|---|---|

| Settlement | Net basis in half-hourly batches | Real-time | Real-time |

| Availability | 24x7x365 | 24x7x365 | 24x7x365 |

| Operator | RBI | NPCI (approved by RBI) | RBI |

| Limit | No fixed limit (varies by bank) | Max ₹5 lakhs | Min ₹2 lakhs, no upper limit |

| Use Case | General retail transfers | Quick fund transfer, merchant payments | Large-value corporate/government payments |

Mains Key Points

Prelims Strategy Tips

National Payments Corporation of India (NPCI)

NPCI is an umbrella organisation created by RBI and Indian Banks’ Association (IBA) under the Payment and Settlement Systems Act, 2007. It provides a secure, affordable and unified digital payments infrastructure in India. NPCI powers UPI, RuPay, IMPS, BHIM, NACH and other innovations that have made India a global leader in fintech.

NPCI is an umbrella organisation created by RBI and Indian Banks’ Association (IBA) under the Payment and Settlement Systems Act, 2007. It provides a secure, affordable and unified digital payments infrastructure in India. NPCI powers UPI, RuPay, IMPS, BHIM, NACH and other innovations that have made India a global leader in fintech.

Major Products of NPCI

| Product | Year | Purpose |

|---|---|---|

| UPI | 2016 | Instant mobile-based fund transfer |

| BHIM | 2016 | UPI-based mobile app for P2P and P2M transfers |

| RuPay | 2012 | Indigenous card payment network |

| IMPS | 2010 | 24x7 real-time fund transfer |

| BBPS | 2017 | One-stop recurring bill payment solution |

| NCMC | 2019 | One Nation, One Card for transport & retail |

| APB | 2013 | Direct Benefit Transfer via Aadhaar |

| NFS | 2004 (migrated to NPCI later) | ATM interconnectivity network |

| NACH | 2012 | Electronic clearing for recurring payments |

Mains Key Points

Prelims Strategy Tips

National Payments Corporation of India (NPCI)

NPCI is the umbrella organisation for retail payments and settlement systems in India. It was created by RBI and Indian Banks’ Association under the Payment and Settlement Systems Act, 2007. It operates on a not-for-profit basis to make India's payment ecosystem affordable, interoperable, and robust.

NPCI is the umbrella organisation for retail payments and settlement systems in India. It was created by RBI and Indian Banks’ Association under the Payment and Settlement Systems Act, 2007. It operates on a not-for-profit basis to make India's payment ecosystem affordable, interoperable, and robust.

Major NPCI Products

| Product | Launch Year | Key Purpose |

|---|---|---|

| UPI | 2016 | Instant mobile-based fund transfer |

| BHIM | 2016 | UPI-based app for easy transactions |

| RuPay | 2012 | Indigenous card network |

| IMPS | 2010 | 24x7 real-time fund transfer |

| BBPS | 2017 | Unified recurring bill payments |

| NCMC | 2019 | One Nation, One Card |

| APB | 2013 | DBT platform for Aadhaar-linked accounts |

| Bharat QR | 2016 | QR-based merchant payments |

| NFS | 2004 (migrated to NPCI later) | ATM interconnectivity |

| NACH | 2012 | Electronic clearing for recurring payments |

Mains Key Points

Prelims Strategy Tips

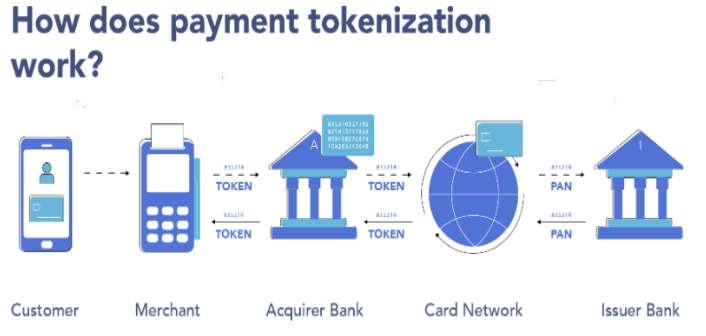

Plastic Money & Card Tokenization

Plastic Money refers to cards (credit, debit, prepaid) that act as substitutes for currency notes. Card Tokenization is an RBI-mandated security process that replaces sensitive card details with a unique token for safer digital transactions.

Plastic Money refers to cards (credit, debit, prepaid) that act as substitutes for currency notes. Card Tokenization is an RBI-mandated security process that replaces sensitive card details with a unique token for safer digital transactions.

Types of Plastic Money

| Type | Definition | Example |

|---|---|---|

| Credit Card | Allows borrowing within pre-approved credit limit | HDFC Credit Card |

| Debit Card | Linked to bank account; purchases deducted directly | SBI Debit Card |

| Prepaid Card | Not linked to bank account; preloaded with money | IRCTC UBI Prepaid Card |

Mains Key Points

Prelims Strategy Tips

Cryptocurrency

Cryptocurrency is a form of digital or virtual currency that uses encryption (cryptography) to secure transactions and regulate creation of new units. It operates on blockchain technology and functions in a decentralized manner, independent of governments or central banks.

Cryptocurrency is a form of digital or virtual currency that uses encryption (cryptography) to secure transactions and regulate creation of new units. It operates on blockchain technology and functions in a decentralized manner, independent of governments or central banks.

Status of Cryptocurrency in India

| Year | Event |

|---|---|

| 2018 | RBI prohibited regulated entities from dealing in cryptocurrencies. |

| 2020 | Supreme Court struck down RBI’s ban, allowing crypto trading. |

| Present | No specific law governing cryptocurrencies in India, but owning is not illegal. |

Mains Key Points

Prelims Strategy Tips

Central Bank Digital Currency (CBDC / e-Rupee)

The Central Bank Digital Currency (CBDC), or e-Rupee, is the RBI-issued digital form of fiat money. It is legal tender, exchangeable 1:1 with cash, and acts as a safe store of value. Unlike cryptocurrencies, CBDC is fully regulated by the Reserve Bank of India.

The Central Bank Digital Currency (CBDC), or e-Rupee, is the RBI-issued digital form of fiat money. It is legal tender, exchangeable 1:1 with cash, and acts as a safe store of value. Unlike cryptocurrencies, CBDC is fully regulated by the Reserve Bank of India.

CBDC vs Cryptocurrency

| Aspect | CBDC (e-Rupee) | Cryptocurrency |

|---|---|---|

| Issuer | Central Bank (RBI) | Private/Decentralized network |

| Legal Status | Legal tender in India | Not legal tender |

| Stability | Stable, backed by RBI | Highly volatile |

| Regulation | Fully regulated by RBI | Unregulated/partially regulated |

| Use | Payments, settlements, inclusion | Investment, speculation, transfers |

Mains Key Points

Prelims Strategy Tips

Money Supply in India

Money supply refers to the total amount of money circulating in an economy at a given time. It plays a crucial role in determining inflation, price levels, and interest rates. In India, the Reserve Bank of India (RBI) publishes four measures of money supply: M1, M2, M3, and M4.

Money supply refers to the total amount of money circulating in an economy at a given time. It plays a crucial role in determining inflation, price levels, and interest rates. In India, the Reserve Bank of India (RBI) publishes four measures of money supply: M1, M2, M3, and M4.

Measures of Money Supply (India)

| Measure | Definition | Liquidity |

|---|---|---|

| M1 | Currency with public + Demand deposits with banks + Other deposits with RBI | Most liquid (Transaction money) |

| M2 | M1 + Savings deposits with Post Office savings banks | Less liquid than M1 |

| M3 | M1 + Time deposits with banks | Broad money, widely used |

| M4 | M3 + All deposits with Post Office savings banks (except NSC) | Least liquid |

Mains Key Points

Prelims Strategy Tips

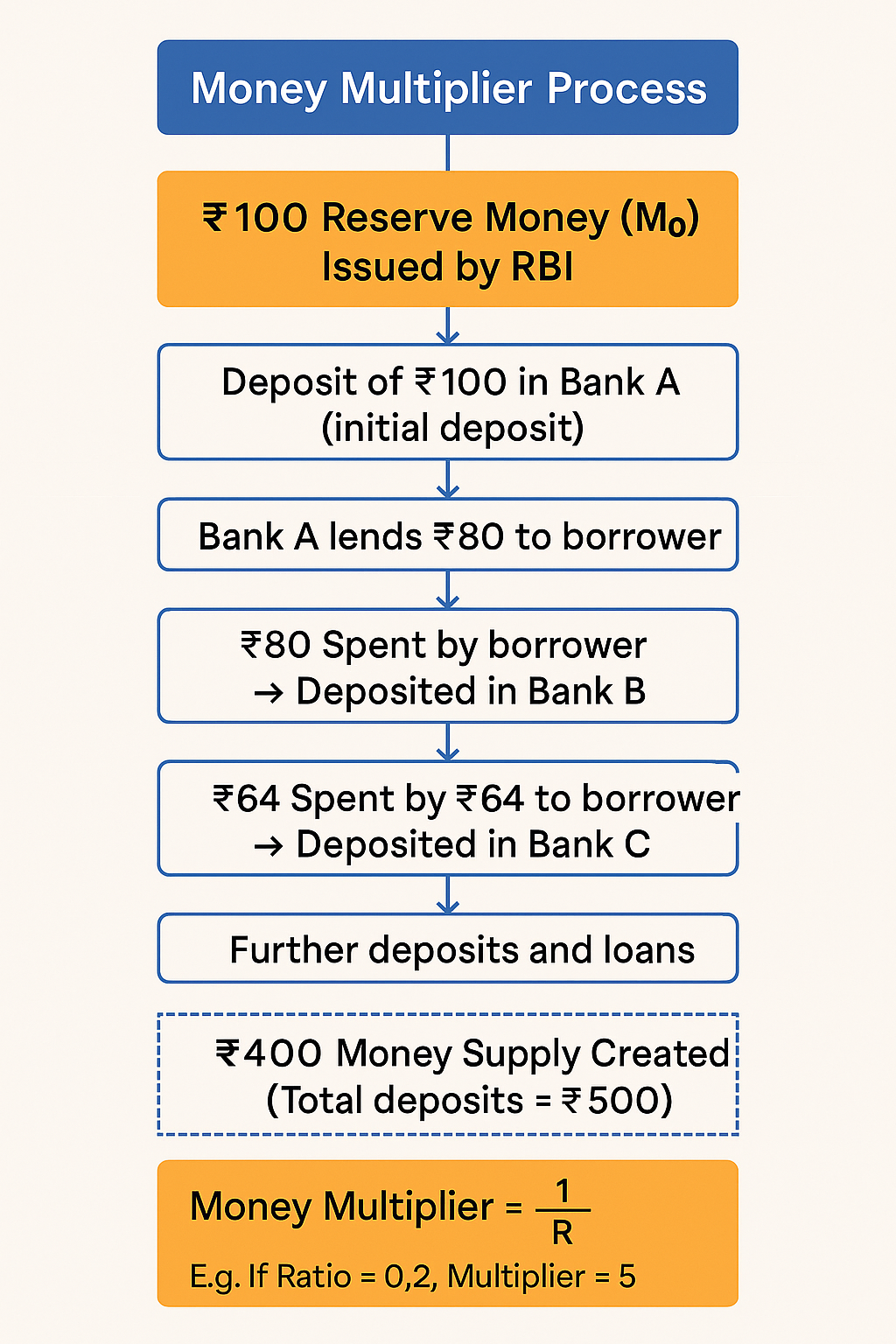

Reserve Money (M0), Demand for Money and Determinants of Money Supply

Reserve Money (M0), also known as High-Powered Money or Monetary Base, is the foundation of money supply in the economy. It represents total liabilities of RBI and forms the base for credit creation. Demand for money arises due to transaction, precautionary, and speculative motives, while determinants like CDR and RDR affect the expansion of money supply.

Reserve Money (M0), also known as High-Powered Money or Monetary Base, is the foundation of money supply in the economy. It represents total liabilities of RBI and forms the base for credit creation. Demand for money arises due to transaction, precautionary, and speculative motives, while determinants like CDR and RDR affect the expansion of money supply.

Key Ratios affecting Money Supply

| Ratio | Definition | Formula | Impact on Money Supply |

|---|---|---|---|

| CDR (Currency Deposit Ratio) | Preference of public for cash vs deposits | C/D | Higher CDR reduces deposits in banks → less lending capacity |

| RDR (Reserve Deposit Ratio) | Fraction of deposits banks keep as reserves | Reserves / Deposits | Higher RDR means more reserves → less lending → reduced money supply |

| CRR | Mandatory reserves kept with RBI | Fixed % of deposits | Higher CRR → reduced money supply; Lower CRR → increased money supply |

| SLR | Mandatory reserves in liquid assets like gold, govt securities | Fixed % of deposits | Higher SLR → reduced money supply; Lower SLR → increased money supply |

Mains Key Points

Prelims Strategy Tips

Money Multiplier, Multiplier Effect and Cashless Economy

Money Multiplier shows how Reserve Money (M0) issued by RBI expands into Broad Money (M3) through bank lending. Multiplier Effect measures how a change in spending leads to larger change in income. Cashless Economy aims at reducing physical cash transactions and promoting digital payments.

Money Multiplier shows how Reserve Money (M0) issued by RBI expands into Broad Money (M3) through bank lending. Multiplier Effect measures how a change in spending leads to larger change in income. Cashless Economy aims at reducing physical cash transactions and promoting digital payments.

Comparison of Money Multiplier vs Multiplier Effect

| Aspect | Money Multiplier | Multiplier Effect |

|---|---|---|

| Definition | Shows expansion of money supply through bank lending | Shows change in income due to change in spending |

| Formula | M3/M0 or 1/Reserve Ratio | ΔIncome / ΔSpending |

| Focus | Banking & credit creation | Overall economy’s output and income |

| Key Factor | Reserve Ratio (CRR, SLR) | Marginal Propensity to Consume (MPC) |

| Impact | Determines liquidity in market | Determines income/output growth |

Mains Key Points

Prelims Strategy Tips

Demonetisation in India (2016)

Demonetisation refers to the process where a government withdraws the legal tender status of a currency note. In India, on 8th November 2016, the government demonetised ₹500 and ₹1000 notes (86% of cash in circulation) to tackle black money, corruption, fake currency, and terror financing. New ₹500 and ₹2000 notes were introduced.

Demonetisation refers to the process where a government withdraws the legal tender status of a currency note. In India, on 8th November 2016, the government demonetised ₹500 and ₹1000 notes (86% of cash in circulation) to tackle black money, corruption, fake currency, and terror financing. New ₹500 and ₹2000 notes were introduced.

Impacts of Demonetisation (2016)

| Aspect | Short-Term Impact | Long-Term Impact |

|---|---|---|

| Cash Availability | Sharp decline, queues at banks | Recovered but lower than earlier |

| Interest Rates | Declined due to liquidity surge | Likely to remain lower |

| Wealth/Assets | Real estate & private wealth declined | Stabilisation, formalisation of assets |

| Digital Transactions | Increased rapidly among new users | Sustained growth in digital economy |

| Economic Growth | Slowed due to disruption in demand and supply | Expected benefits if formalisation continues |

Mains Key Points

Prelims Strategy Tips

Chapter Complete!

Ready to move to the next chapter?